Unilever's new CEO Fernando Fernandez recently participated in a "fireside chat" with Barclays to address investor concerns following the leadership change. While he never explicitly mentioned retail media or ecommerce marketplaces during the interview (unusual in itself), his comments reveal significant implications for Unilever's approach to digital marketplaces and retail platforms.

I'll break down some of the key themes from the fireside chat and what Fernandez' vision means for consumer goods competitors, as well as for retail media networks. Please note that a very wide range of topics were discussed, including a big focus on Unilever's international markets. For the purpose of this breakdown, I'm focusing on implications for CPG brands and RMNs, and largely those operating in the US market.

Where's the Retail Media?

But first, one of the most striking aspects of Unilever CEO Fernando Fernandez's recent "fireside chat" with Barclays isn't what he said—it's what he didn't say. In an era where digital commerce dominates CPG strategy discussions, Fernandez's complete omission of retail media and e-commerce stands out as unusually conspicuous.

This silence is particularly notable because:

- Most major CPG CEO speeches or investor calls in the last few years have included specific references to e-commerce channels and retail media, reflecting their importance in modern consumer engagement.

- Peer companies like Procter & Gamble, Nestlé, and PepsiCo consistently highlight Amazon, Walmart Connect, or their own D2C channels when discussing marketing mix shifts, ROI, and digital acceleration.

- Unilever itself has historically featured e-commerce updates in earnings calls under previous leadership, making Fernandez's omission all the more striking.

The omission is conspicuous because it runs counter to a near-universal pattern in CPG leadership communications, where digital commerce—and especially retail media—is highlighted as a key growth vector. Even if Fernandez plans to invest heavily in these channels, not mentioning them in a major first interview seems unusual to me.

The Marketing Investment Surge

One of the most striking revelations is Unilever's dramatic increase in Brand and Marketing Investment (BMI). The company has moved from what Fernandez called a "non-competitive" 13.1% of sales in 2022 to 14.3% in 2023, with projections reaching 15.9% by late 2024. Fernandez didn't mince words about the previous spending level, noting there's "an implicit recognition that our level of investment in 2022 was noncompetitive."

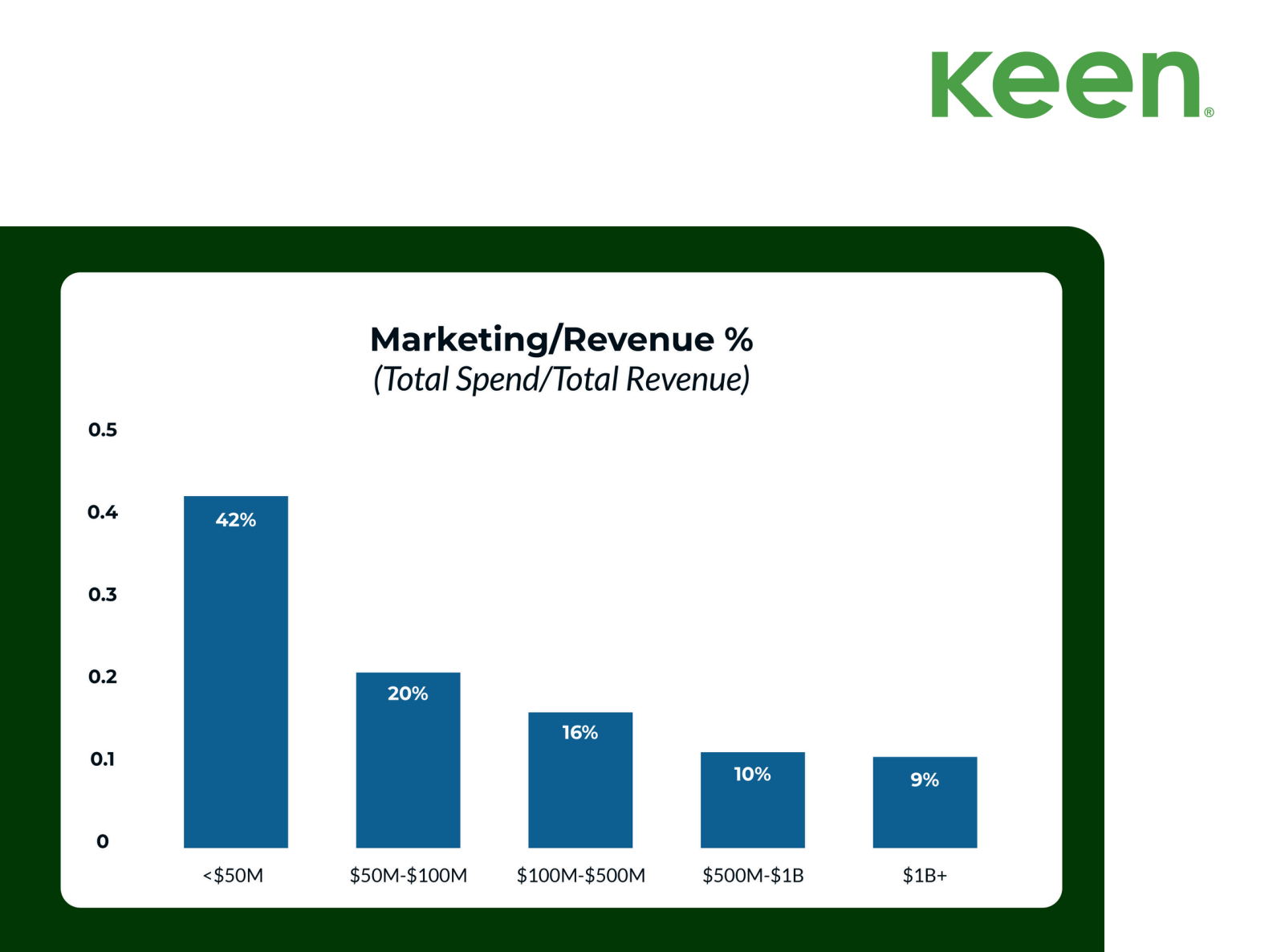

This reminded me of some research that I came across recently and have been saving for a rainy day. Keen Decision Systems' 2024 Marketing Insight Report had a neat breakdown of 350 consumer brands' marketing investment relative to revenue.

According to Keen's research, enterprise brands with >1BN revenue typically are spending 9% of revenue on marketing. Unilever's goal to spend 15-16% of revenue on marketing appears very ambitious.

This aggressive stance on marketing investment comes at a time when many CPGs have pulled back spending due to inflation and margin pressures.

The Social-First Revolution

Perhaps the most transformative element of Fernandez's strategy is to eschew mass advertising campaigns and pivot to highly localized influencer marketing. In his words: "marketing activity systems in which others can speak for your brand at scale." His ambition is staggering—recruiting influencers down to the municipality level:

"There are 19,000 postcodes in England. In Brazil there are 5,764 municipalities. I want one influencer in each of them...in some of them I want 100."

Fernandez believes Unilever can tap into local authenticity—where brand messages come from someone who’s ‘one of you’ rather than a big corporate entity.

This represents a fundamental shift away from traditional corporate messaging, which Fernandez bluntly describes as "suspicious." Instead, he's betting on authenticity through third-party voices, requiring a "machine of content creation very different to the one we have had in the past."

AI-Powered Localization

The scale of content creation Fernandez envisions would be impossible without technological intervention. He explicitly calls out AI's role in scaling this massive influencer operation. This suggests Unilever is building capabilities to produce high volumes of localized, targeted creative.... which could also feed into retail media platforms.

The Premium Push

Fernandez also revealed Unilever's aim to have 50% of its business in the "premium" segment. This premiumization strategy has major implications for retail media:

- Higher Margins: Premium products can justify more aggressive advertising spend, potentially making retail media's pay-to-play model more palatable.

- Enhanced Product Detail Pages: Premium positioning requires exceptional online presentation—from enhanced content to compelling images and authentic reviews—all areas where retail media networks are expanding offerings.

What This Means for Retail Media Networks

Though Fernandez never explicitly mentions retail media, the implications for platforms like Amazon, Walmart Connect, and other e-commerce channels are significant:

- Higher Marketing Budgets: The substantial increase in BMI will likely include more spending on retail media placements, sponsored products, and display ads across digital marketplaces.

- Influencer-to-E-commerce Pipeline: The influencer-first strategy creates a natural funnel to e-commerce product pages, potentially driving higher-quality traffic to retail media placements.

- Accountability Pressure: Fernandez emphasizes Unilever's proprietary "UBS methodology" for measuring marketing performance, stating that investments must deliver "higher returns versus any alternative allocation of funds." This will place significant pressure on retail media networks to prove their ROI. Driving down costs in other areas of the business – particularly procurement - was a key talking point for Fernandez, but it follows that media and marketing ROI also be under the microscope. With Fernandez's strict ROI yardsticks, retail media networks must prove their incremental value. This will be particularly challenging for smaller networks that, as I've written about extensively, already struggle with transparency and measurement issues.

- Integrated Approaches: Successful platforms will need to demonstrate how they can integrate with Unilever's influencer-led strategy, potentially offering new types of influencer collaborations or sponsored content.

What This Means for Other Consumer Brands

Unilever's strategic shift under Fernandez has significant implications for competitors and other consumer brands operating in the retail media space:

1. Increased Competition for RMN Inventory—and Rising Costs

With Unilever dramatically increasing their overall marketing investment from ~13% to ~15-16% of revenue and likely allocating a substantial portion to retail media, other brands should prepare for:

- Higher Auction Prices: As more Unilever marketing dollars pour into sponsored product listings, display ads, and brand stores on retail media networks, CPCs and CPMs are likely to rise, especially in competitive categories. Brands must be prepared for a more expensive pay-to-play environment.

- Budget Allocation Agility: If costs spike on dominant platforms like Amazon, brands should consider diversifying spend across other retail media networks or rebalancing between brand-building and lower-funnel tactics to maintain efficiency.

2. Battle for "Premium" Perception Within E-Commerce

Unilever's shift toward positioning 50% of its portfolio as "premium" despite potential consumer spending slowdowns creates both challenges and opportunities:

- Strategic Positioning Choices: Competitors must decide whether to compete directly in the premium space or reinforce value propositions for price-sensitive segments that Unilever might be de-emphasizing.

- Enhanced Content Investment: To compete in the premium space, brands will need to utilize brand stores and enhanced content modules (like A+ Content on Amazon) to convey higher-value brand stories—ideally complemented by influencer endorsements.

- Exclusive Offerings: Consider developing unique bundle offerings or limited-edition SKUs exclusive to specific retail media networks, which can justify higher price points and create a sense of scarcity.

3. AI-Powered Content Creation and Optimization

Unilever's use of AI to produce vast amounts of localized, influencer-driven content sets a new benchmark:

- Automated Creative Production: Brands should explore AI-driven solutions to produce multiple versions of product images, ad copy, and videos tailored to different geographies or consumer segments—at scale and cost-effectively.

- Dynamic Testing: Implement AI-powered dynamic content testing to optimize retail media creative in real-time based on performance metrics, potentially gaining efficiency advantages over less agile competitors.

4. Strategic Opportunities in Unilever's Blind Spots

Any major strategic shift creates potential gaps that competitors can exploit:

- Value Segment Opportunities: As Unilever focuses on premium positioning, brands can target cost-conscious consumers with performance-driven retail media ads highlighting affordability and value, potentially capturing market share in segments Unilever may be deprioritizing.

- Direct Retail Partnerships: While Unilever channels resources to influencer-based brand-building, competitors might strengthen co-marketing efforts directly with retail networks through negotiated search brand amplification or special brand day takeovers.

- Measurement Advantage: Brands that develop superior ROI measurement capabilities for retail media may gain advantage over competitors still using traditional metrics, allowing for more efficient spend allocation and better negotiations with retail media networks.

The Bottom Line

Fernandez's omission of retail media from his investor discussion doesn't mean it's unimportant—rather, it's likely become table stakes in Unilever's marketing mix. The real transformation lies in how these platforms will need to adapt to Unilever's new social-first, influencer-driven, and ROI-focused approach.