In the classic board game Risk, players maneuver armies across continents, form strategic alliances, and attempt to control territory. Today, a similar high-stakes game is unfolding in the digital realm as tech giants position their AI shopping agents to capture the most valuable territory of all: consumer purchasing decisions.

The latest move in this global game? OpenAI's apparent preparation to integrate Shopify-powered native purchasing directly within ChatGPT conversations that was "leaked" last week.

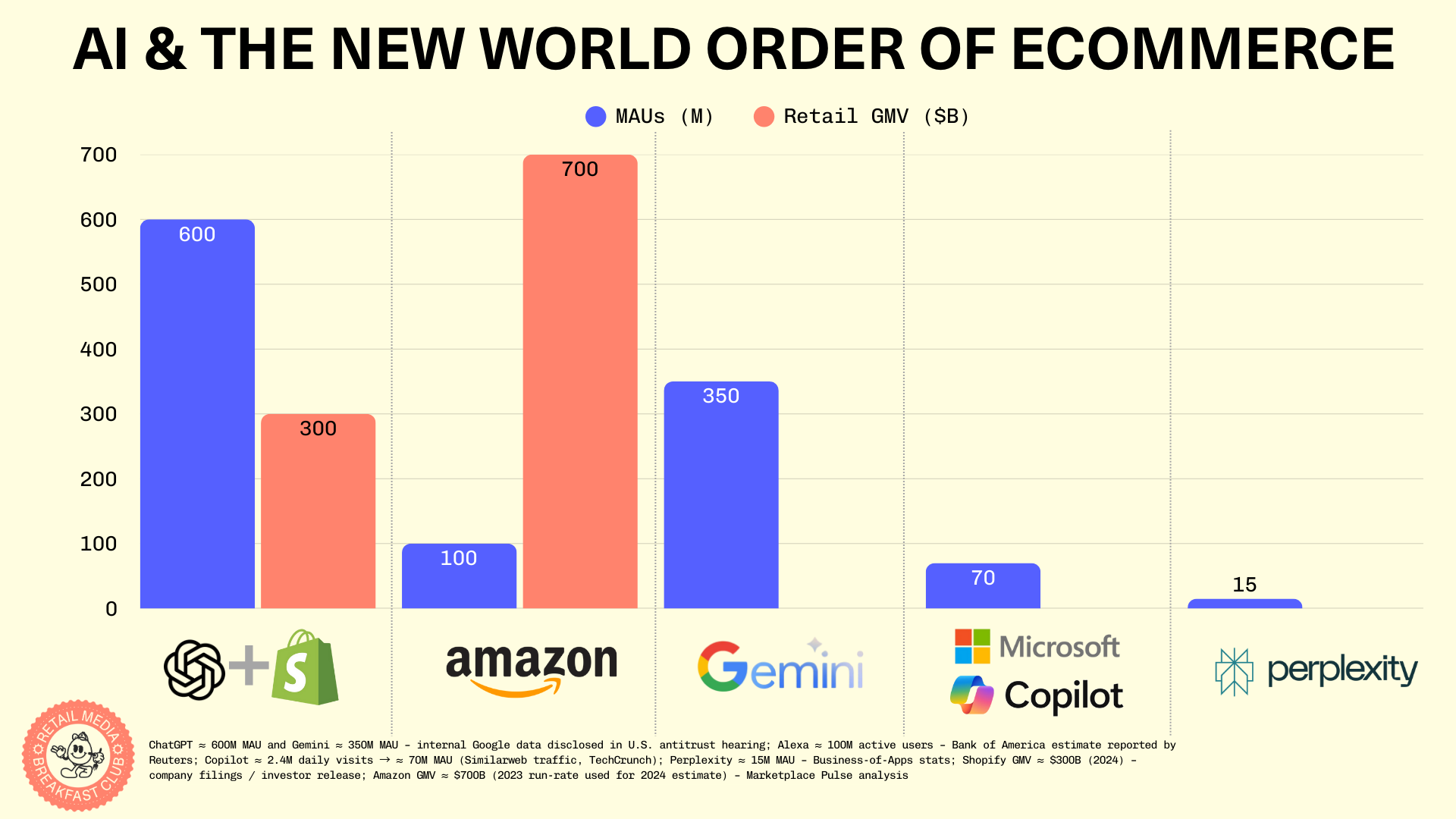

Recently discovered code suggests direct Shopify integration for in-chat purchasing—transforming ChatGPT from an information tool into an end-to-end shopping platform. But while this development has piqued a lot of interest, this is far from the only shopper agent we have seen so far, or will see in the near future. Let's first have a look at the main players' battle stats.

The Major Powers Stake Their Claims

Like any good Risk game, several major powers have emerged, each with distinct advantages:

OpenAI/ChatGPT: With the largest number of active users of any LLM by far, OpenAI's strength is in its massive consumer reach. Powered by its new o3 and o4-mini models with "early agentic behavior," ChatGPT can now independently decide which tools to use without prompting. The alliance with Shopify gives it access to millions of merchants.

Amazon: Amazon has already outpaced all its retail brethren who are distracted with deploying on-site chatbots. Among its string of agentic AI bows, Amazon has released these agents in the past 6 months:

- Amazon Alexa+: The bones of a true consumer-facing agent that performs shopping research and transactions. (link to my explainer article)

- Nova Act: a new AI model designed to take autonomous actions across the web (not just shopping). Available right now to developers, this tech could underpin Alexa+. (link to my explainer article)

- Buy For Me: An agent currently in beta that allows Amazon shoppers to purchase non-Amazon products, right within the Amazon shopping app. (link to my explainer article)

Amazon's strength lies in its massive product catalog, logistics infrastructure, and the 200+ million Prime members globally. But.... Amazon falls short in the LLM usage department. Alexa may be Amazon's closest proxy to a LLM today, but even the most enthusiastic Alexa users wouldn't compare it to any of the existing competitors.

Perplexity: This AI search company wins the early mover card, despite being a smaller LLM with 10M MAUs. It already launched its "Buy with Pro" feature, allowing users to make purchases through its AI interface. Perplexity represents an emerging power and a potential future ally for retailers who value neurtrality.

Microsoft: Having rolled out its official Copilot Merchant Program in April 2025, Microsoft's key strength in this battle is its existing partnerships with major retailers.

Google: Later to the AI assistant game, Google's massive search data and Android user base could make it a formidable player if it integrates more shopping capabilities into its Gemini assistant.

Other strategic players are positioning themselves as crucial allies to LLMs and retailers, such as Salesforce's Einstein AI platform, which helps retailers manage relationships with multiple AI shopping agents, potentially serving as a neutral intermediary in the AI commerce landscape.

3 Critical Capabilities

For an AI agent to successfully facilitate shopping, three critical capabilities are emerging as the "rules of the game":

- Real-time catalog and inventory feeds: Agents need accurate, up-to-date product information to make relevant recommendations. Without this, they risk suggesting unavailable items or missing new products; AND

- Authenticated checkout tokens: To actually complete purchases without redirecting users to other platforms, agents need secure payment processing capabilities and merchant authorization; OR

- Openness to third-party integration: Retailers must decide whether to allow external AI agents to access their platforms or block them to maintain direct customer relationships.

A credible agentic-commerce flow must let customers see a product and buy it inside the chat. That means you need 1+2 or 1+3 of the above, and ideally all three.

How Retailers Stay on the Board: Pick a Side or Run Your Own Gateway

In this high-stakes game, retailers face a critical decision: which alliance will help them maintain relevance as AI shopping agents reshape consumer behavior?

Most retailers and brands will ally with a power-bloc—installing Shopify's ChatGPT module, joining Copilot Merchant, or syndicating feeds to Perplexity—because that's the quickest way into consumer conversations. The risk is channel dependence and lost data.

One solution may be Model Context Protocol (MCP). MCP acts like USB-C for AI agents: one standardized connection that exposes products, inventory, loyalty, coupons, and checkout capabilities to any compliant model. A retailer can grant access to several LLMs including OpenAI, Claude, or Gemini, preserving data sovereignty while still showing up in chat results.

This gives retailers the opportunity to participate in multiple AI marketplaces without surrendering customer data or pricing logic while still participating in the AI shopping revolution.

The Global Conquest Continues

Like a game of Risk that stretches into the early hours, the battle for AI shopping dominance is just beginning. Alliances will form and dissolve, territories will be contested, and new powers may emerge.

We haven't even discussed what happens to the $65BN retail media industry when AI agents become a primary shopping interface (I plan to cover this in the future, so be sure to subscribe for that!)

The next moves in this high-stakes game will likely come rapidly, as OpenAI's shopping integration comes online and Amazon responds with its own consumer-facing agent capabilities. In this new battle, the conquest has only just begun.