When I wrote about transparency challenges in retail media networks for Forbes last week, I knew there were significant performance gaps between industry leaders and the rest of the pack. But new data from the Path To Purchase Institute in partnership with Transunion reveals just how massive this divide really is – and it's a wake-up call for retailers.

The P2PI/Transunion report included a section where participants (67 total, specifically in the CPG category) rated the RMNs that they manage across a few factors. Half of the survey takers said their organizations are currently working with more than five RMNs, while 30% said they’re working with 10 or more.

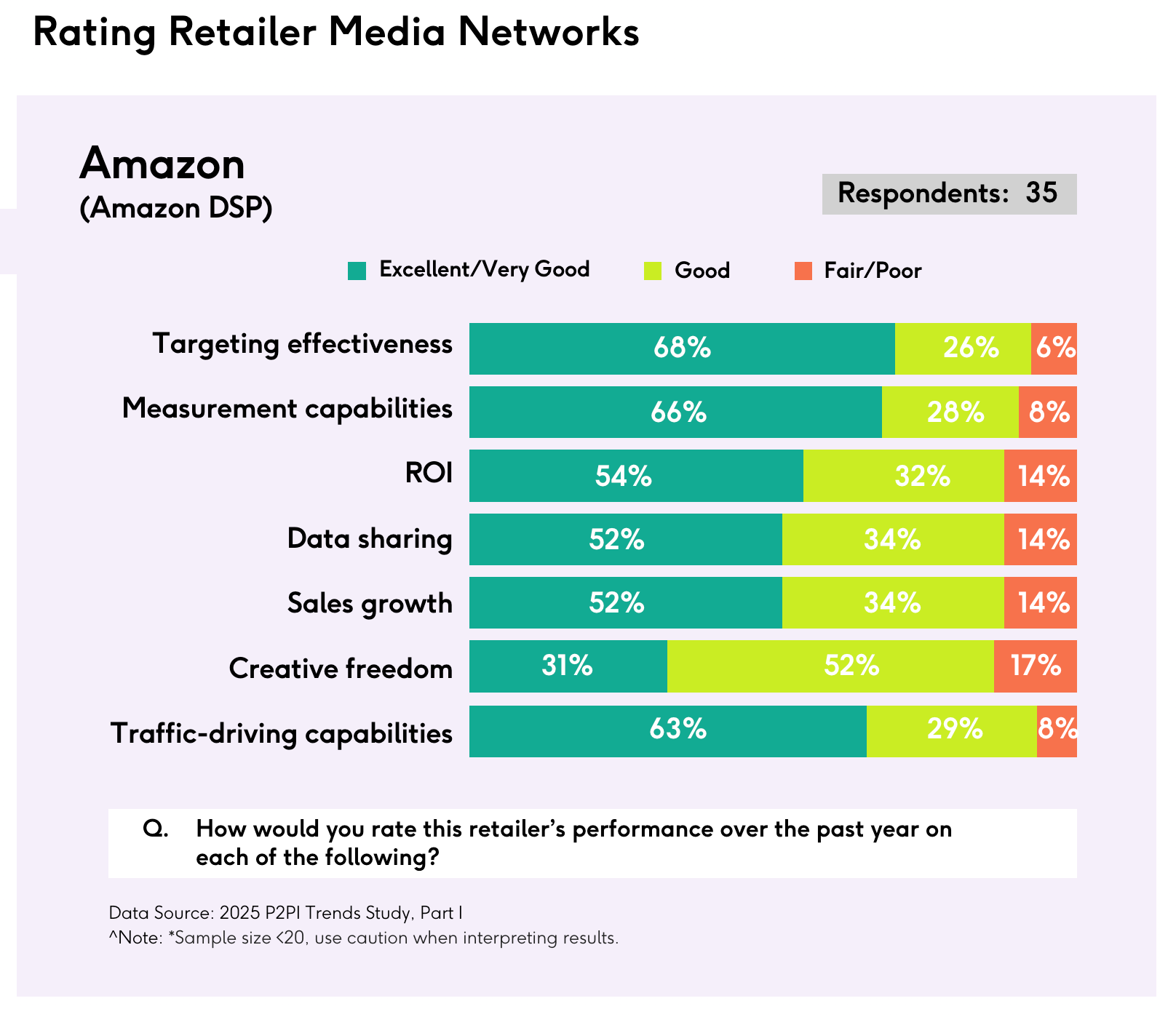

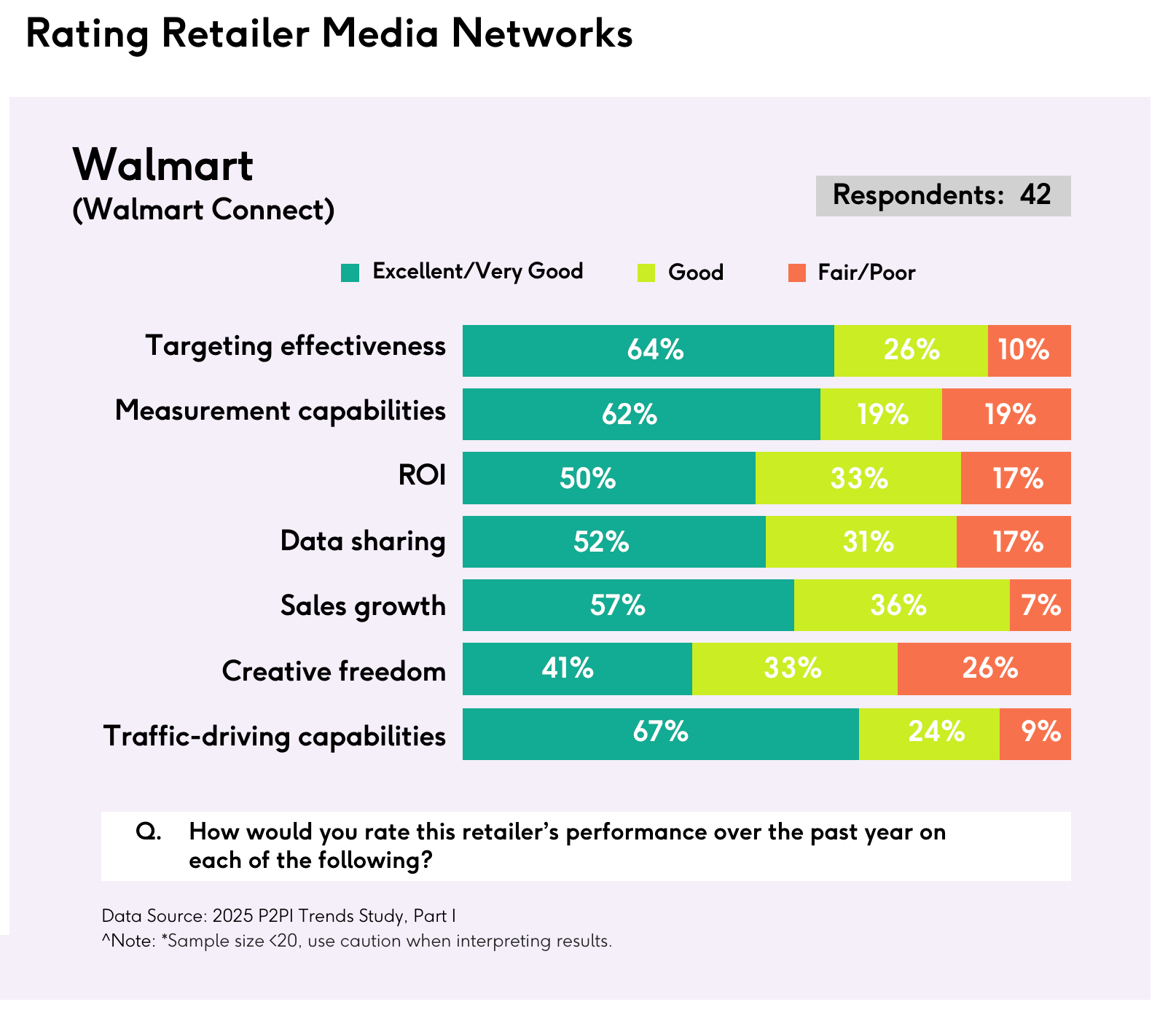

Here's where the great divide in the race shows up. While Amazon's DSP is hitting it out of the park with 68% "Excellent/Very Good" ratings for targeting effectiveness and 66% for measurement capabilities, some of the industry's newer entrants are posting numbers that should make any advertiser pause. Take Dollar General, where a staggering 79% of advertisers rate their ROI as "Fair/Poor." Or BJ's, where 70% of advertisers give thumbs down to both measurement capabilities and ROI.

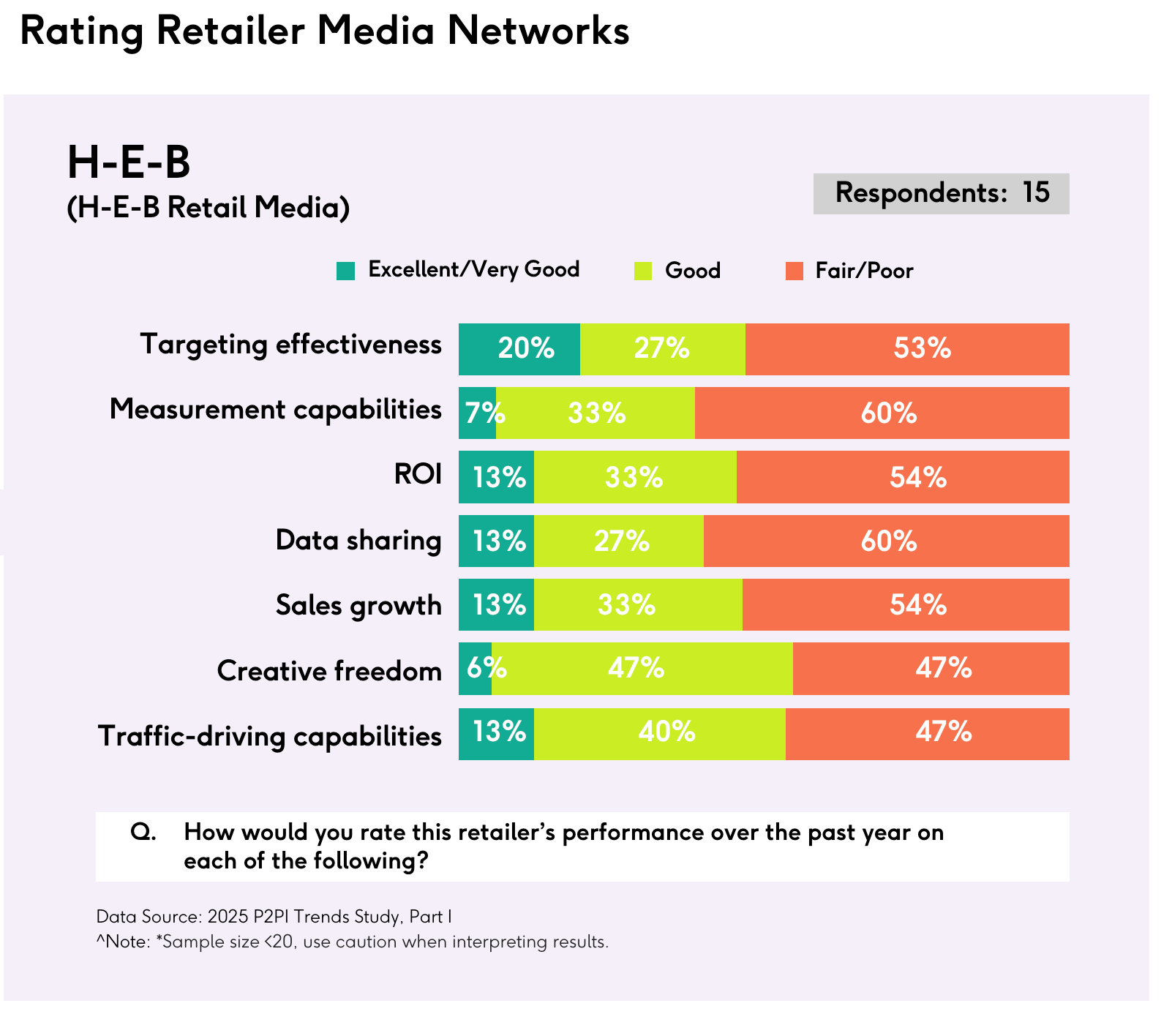

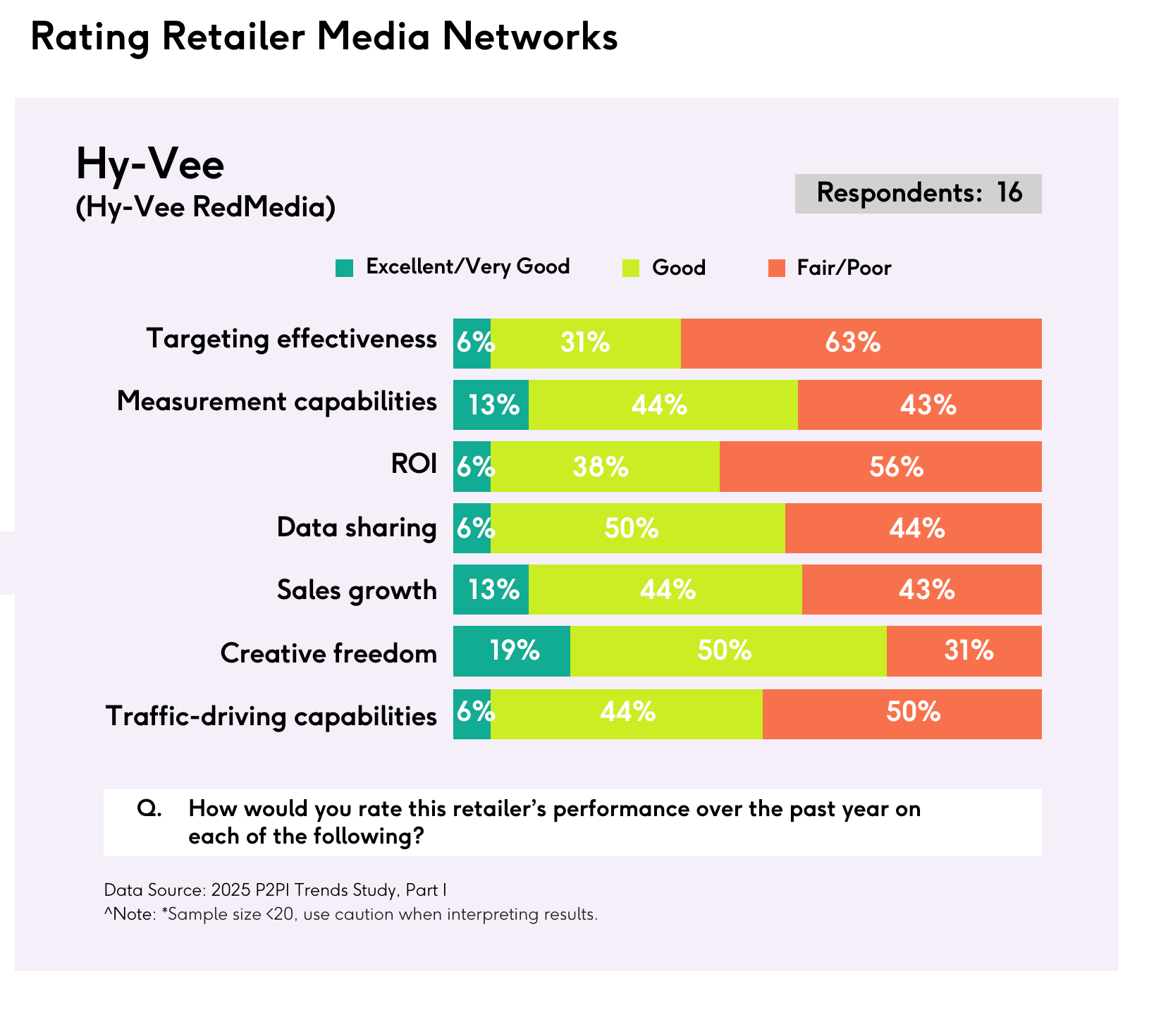

The contrast is stark: Amazon maintains "Fair/Poor" ratings below 8% across key metrics, while networks like Albertsons and H-E-B are seeing 60-65% of advertisers rate them poorly on crucial capabilities like measurement and data sharing. This isn't just a gap – it's a chasm.

A Tale of Two Tiers

Just look at the numbers:

Amazon and Walmart (Top Tier):

- 50-70% "Excellent/Very Good" ratings across core metrics

- Less than 20% "Fair/Poor" ratings

- Strong data transparency (only 14% "Fair/Poor" for Amazon)

- Consistently high ROI satisfaction

Contrast that with the lower tier:

- H-E-B: 60% "Fair/Poor" on measurement

- Dollar General: 57% "Fair/Poor" on measurement

- BJ's: 70% "Fair/Poor" in both measurement and ROI

- Albertsons: 65% "Fair/Poor" in data sharing

- Ahold Delhaize: 67% "Fair/Poor" in ROI

This divide becomes even more critical as the industry faces its first major growth slowdown. As I reported in Forbes, retail media spending growth is expected to decelerate to 15.6% in 2025 from 25.1% in 2024, according to IAB data. In this environment, these performance gaps aren't just numbers – they're likely to determine which networks survive and thrive.

Some Bright Spots in the Middle

It's not all doom and gloom for the non-Amazon crowd. Some networks are showing real promise. Kroger Precision Marketing often hits 50% "Excellent/Very Good" ratings in targeting and measurement, while Instacart Ads is posting impressive numbers for ROI (48% "Excellent/Very Good") and sales growth (49%).

Even Costco, despite being relatively new to the self-serve ad game, shows potential with 24% "Excellent/Very Good" ratings in targeting and ROI. Though they still have work to do – their 6% scores in measurement and data sharing won't cut it in today's market.

What This Means for the Industry

For advertisers, the message is clear: the data backs up what many have suspected about the vast performance gap between top-tier and emerging RMNs. As one media executive recently told Digiday, many networks are asking advertisers to operate on "totally blind trust" – a tough ask when the performance data looks like this:

Retailers are offering retail media solutions that aren’t technically retail media, said a second media executive who asked to remain anonymous in exchange for candor. “They’re co-opting dollars and sending them to another large enterprise agency, a holding company, network of agencies,” the second exec said. Media buyers have to have “totally blind trust” that a retailer is adhering to industry standards as opposed to grading their own homework.

Here's a perfect example of why transparency matters so much: Jordan Witmer, Managing Director of Retail Media at Nectar First, recently shared with me how one major retail network responded when advertisers started identifying and opting out of poor-performing placements based on viewability metrics. Instead of improving the quality of these placements, the network simply removed advertisers' ability to select specific placements entirely, forcing them to buy bundled packages that obscured the poor performers.

The path to competing with Amazon and Walmart isn't a mystery – it runs straight through improved measurement capabilities, better data transparency, and demonstrated ROI. The question is: which networks will make the investments needed to close the gap?

As we watch retail media networks expand into off-site advertising and struggle with standardization (according to the ANA, 57% of advertisers cite this as their top challenge), these performance metrics become even more crucial. In an industry where "trust but verify" is becoming the norm, networks that can't demonstrate their value with hard data may find themselves fighting an uphill battle for advertiser dollars.