Welcome back to the second installment of my mini-series with Jordan Witmer, Managing Director of Unified Commerce at Nectar First. In Part 1, we introduced the concept that "retailers are becoming retailers again".

Today, we're diving deeper into the technology powering retail media networks and why transparency (or lack thereof) matters to advertisers.

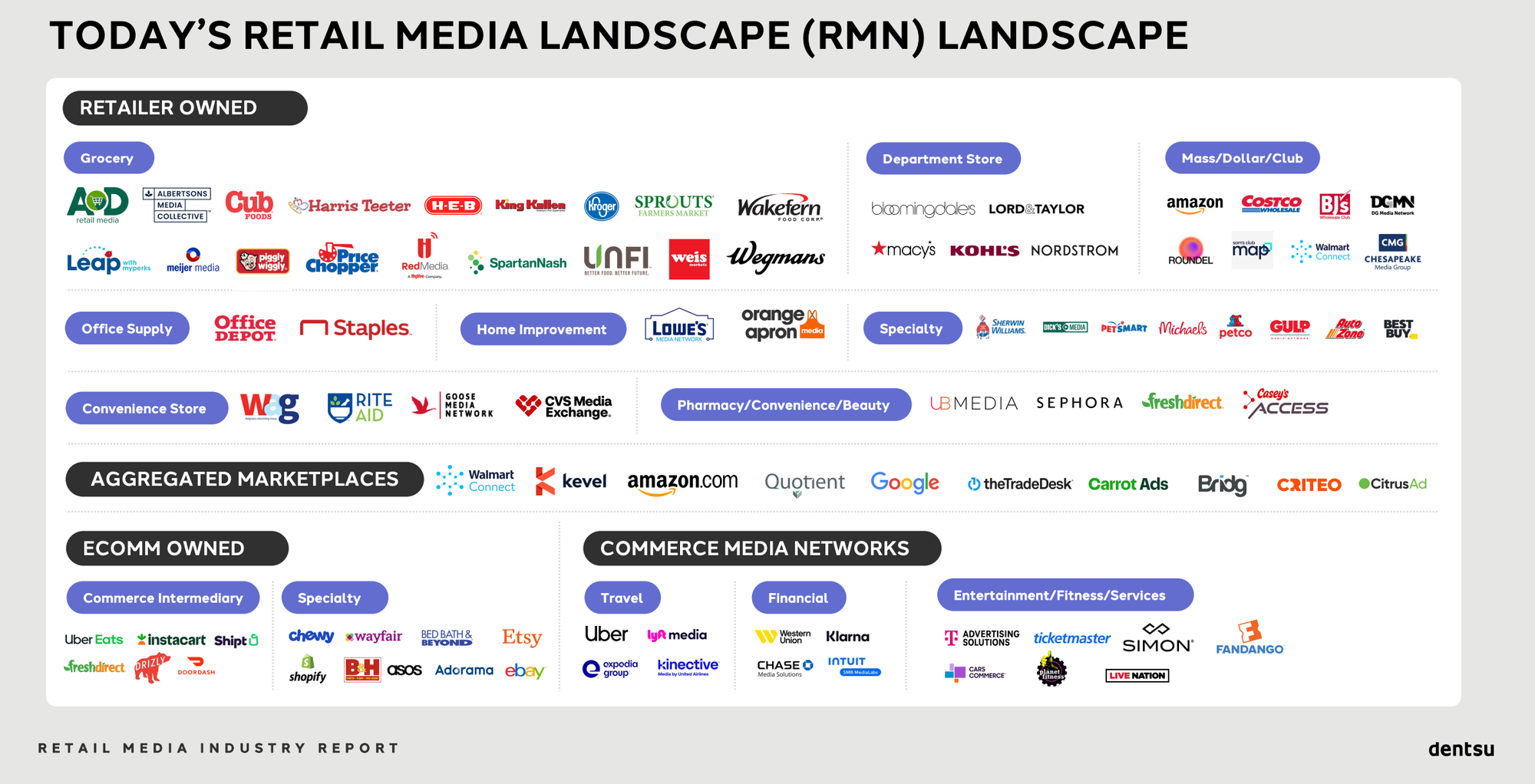

The Myth of 250 Unique Retail Media Networks

One of the most illuminating insights from our conversation is that while the industry talks about hundreds of retail media networks, the reality is far simpler beneath the surface. As Jordan explained, despite the proliferation of what appears to be 250 distinct retail media networks, there are likely only five or six backend technologies powering most of them.

This creates an interesting dynamic where agencies and media buyers who can identify the underlying technology gain an immediate advantage. "Our solve for proliferation of retail media networks is getting good at identifying what that tech is," Jordan noted. Once you recognize which system you're working with, managing campaigns becomes significantly easier.

The Major Players Behind the Curtain

Jordan highlighted several key technology providers that power much of the retailer's side of the tech stack (the SSP and ad server, and sometimes even the DSP): Criteo, Citrus Ad, Moloco, and The Trade Desk, among others. These companies provide the infrastructure for both onsite and offsite retail media capabilities.

For media buyers, recognizing these patterns creates efficiency. As Jordan put it, once you realize what system you're dealing with, you're essentially "buying on the other side of the mirror," which streamlines campaign management considerably.

Note, I recently created an overview of the retail media tech ecosystem that I shared in a video on LinkedIn. I plan to jazz this map up a bit in the future, if there's enough interest – let me know!

How to Identify What's Under the Hood

For those looking to understand what technology is powering a retail media network, Jordan shared two primary approaches:

- Ask about targeting capabilities: Understanding how the bid moves through their system and whether it's a product-first or keyword-first approach can quickly reveal which technology platform is being used.

- Examine the reporting: The terminology, metrics, and format of reporting are often dead giveaways of the underlying technology. As Jordan explained, these reports "look identical retailer to retailer" because they're simply plugged into the same systems.

Red Flags for Media Buyers

When I asked Jordan about red flags that media buyers should watch for, his answer was straightforward: lack of transparency is the biggest concern.

"Usually the red flag is 'I can't really tell you that,'" Jordan explained. This becomes particularly problematic when dealing with fundamental questions about campaign performance. He cited examples of retail media partners who won't disclose which keywords ads served on - information that's critical for optimizing campaigns and justifying spend.

This echoes a situation Jordan previously shared with me for a recent Forbes article, where a retailer wouldn't allow his team to remove low-viewability placements from a campaign bundle. When the next year's packages were released, the only option was to purchase a more premium package at a 40% higher CPM to avoid those low-performing placements.

The Value of Standardization

While retailers may be hesitant to acknowledge they're using the same technology as competitors, from an advertiser's perspective, standardization offers significant benefits. It reduces the learning curve for managing multiple retail media networks and creates more consistent measurement across platforms.

The tension between retailers' desire to differentiate their offerings and advertisers' need for transparency and standardization continues to shape the evolution of the retail media landscape.

Tomorrow, I'll share part 3 of my conversation with Jordan, exploring where the retail media ecosystem is headed and what both retailers and advertisers should be preparing for. Stay tuned for the final installment in this series.