Last summer I took my 8-year old son to a carnival while visiting friends in Cleveland. We warmed up with some sedate rides and then turned our attention to the most exciting ride: The Wipeout.

Like any 8-year-old, he's an aspiring YouTuber and so I dutifully filmed the experience. At first he's grinning while commentating as the ride starts. Then he gets a bit wobbly. "I hate it," he says, still with a smile on his face. Suddenly his face changes as his stomach drops. He's not having fun anymore. "Get me off. Get me off" are the last words he says before the video cuts off.

What my son experienced in 60 seconds, the consumer economy is experiencing across different product categories - simultaneous resolve and fear, often within the same shopping cart. On one side, we're seeing dramatic spikes - baby formula sales up a staggering 26× week-over-week as consumers stockpile ahead of expected tariffs. On the other, average selling prices across Amazon's top sellers have dropped 0.8% year-over-year as shoppers increasingly hunt for bargains.

With this new data from Momentum Commerce, we're seeing what I can only describe as a "frugal frenzy" – a contradictory behavior where consumers are panic buying certain products while actively seeking cheaper alternatives across most categories. This isn't just business as usual with some categories up and others down; it's a genuine economic whiplash that creates both urgent challenges and opportunities for brands selling online.

Let's dive into the big trends from this data and what they mean for your brand strategy in this volatile environment.

The Frugal Shopper Paradox

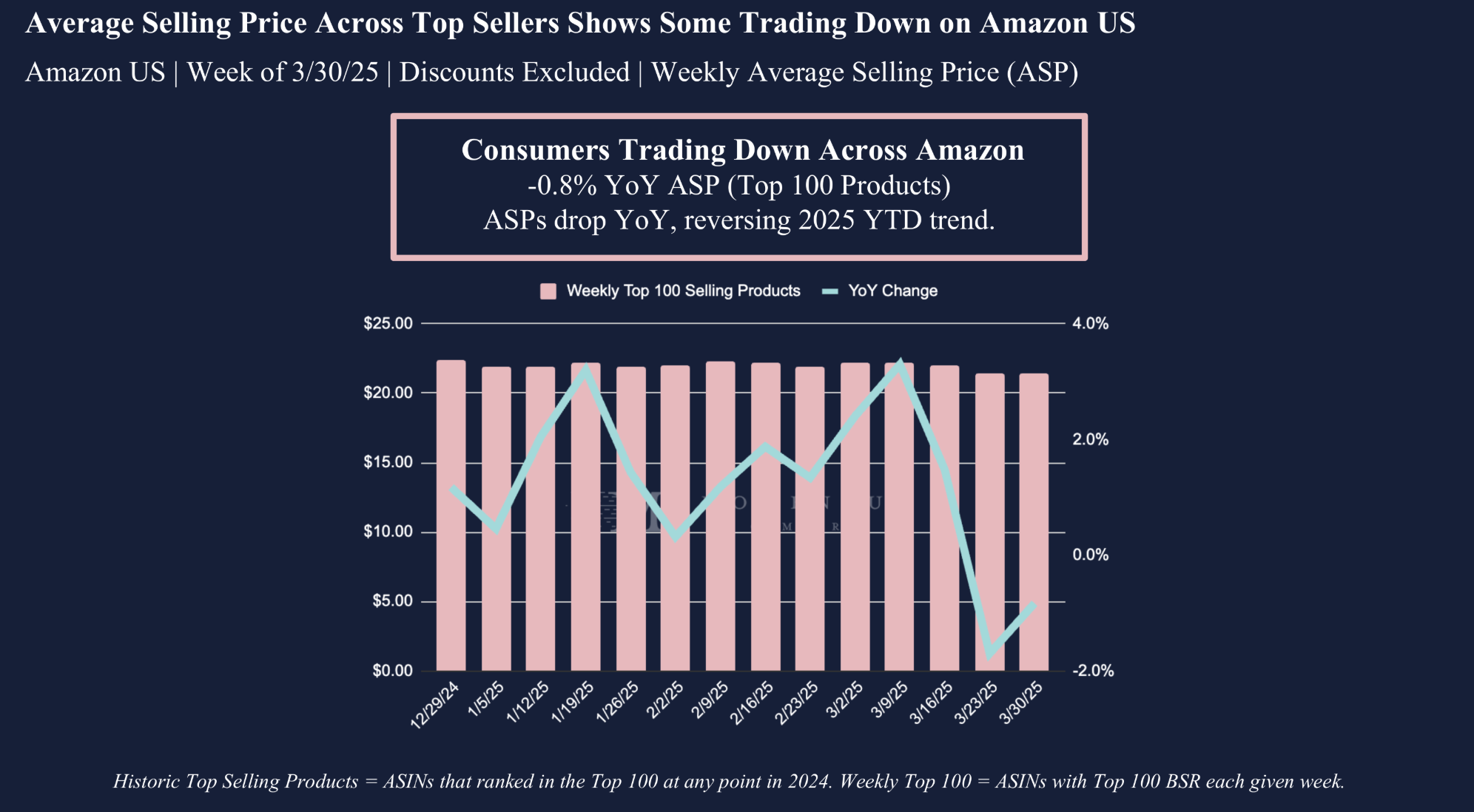

Here's what's happening: Among Amazon's top 1,000 sellers, the average selling price is down 0.8% year-over-year – reversing what had been an upward trend earlier in 2025. This dip is significant because it signals that even as consumers are buying more (in some cases, a lot more), they're gravitating toward cheaper options.

Think about that for a second. Shoppers are concerned enough about potential shortages or future price hikes that they're stockpiling goods, but they're price-conscious enough to seek out bargains while doing it. It's panic buying on a budget.

Trading Down on Daily Essentials

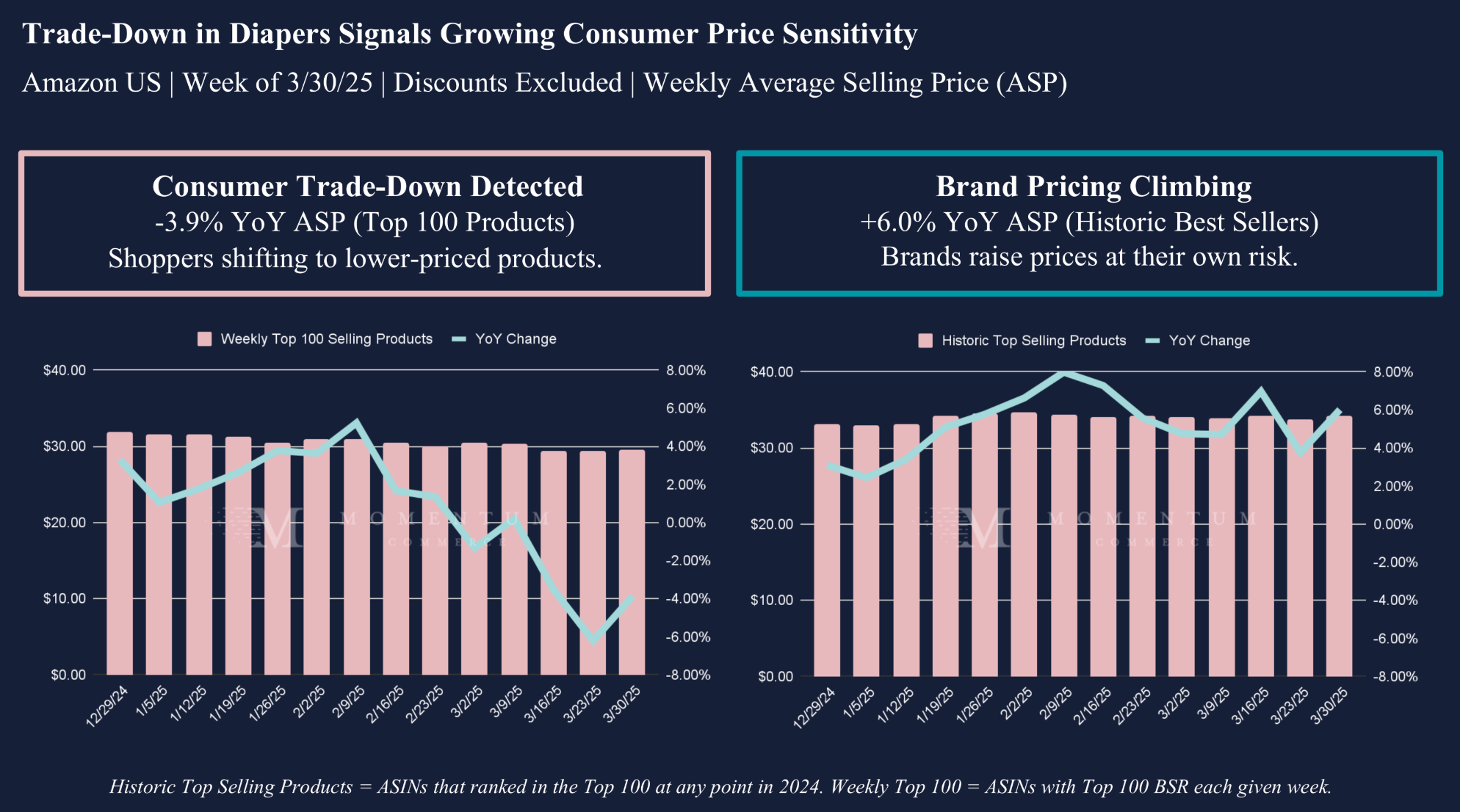

The evidence is clearest in everyday necessity categories. Take diapers, for example. Historically dominant brands have raised prices, but Momentum's data shows they're losing ground to more affordable alternatives.

For the current Top 100 diaper products on Amazon, the average selling price (ASP) is down 3.9% year over year.

Meanwhile, the “historic best sellers” (diaper ASINs that were in the Top 100 at any point in 2024) raised their prices by 6.0% YoY.

This isn't just about saving a few dollars. It represents a fundamental shift in consumer psychology – even on items parents need for their babies, shoppers are increasingly willing to experiment with less expensive brands.

Panic Buying Creates Volatility

What makes this environment especially challenging is the overlay of panic buying in certain categories. Momentum notes some particularly crazy spikes:

- Baby formula sales up 26× week-over-week

- Olives & antipasto up 13.7×

- Yoga clothing and supplies up 13.3×

These aren't seasonal surges – they reflect stockpiling behavior, likely driven by concerns about potential tariffs and supply chain disruptions.

Not All Categories Are Created Equal

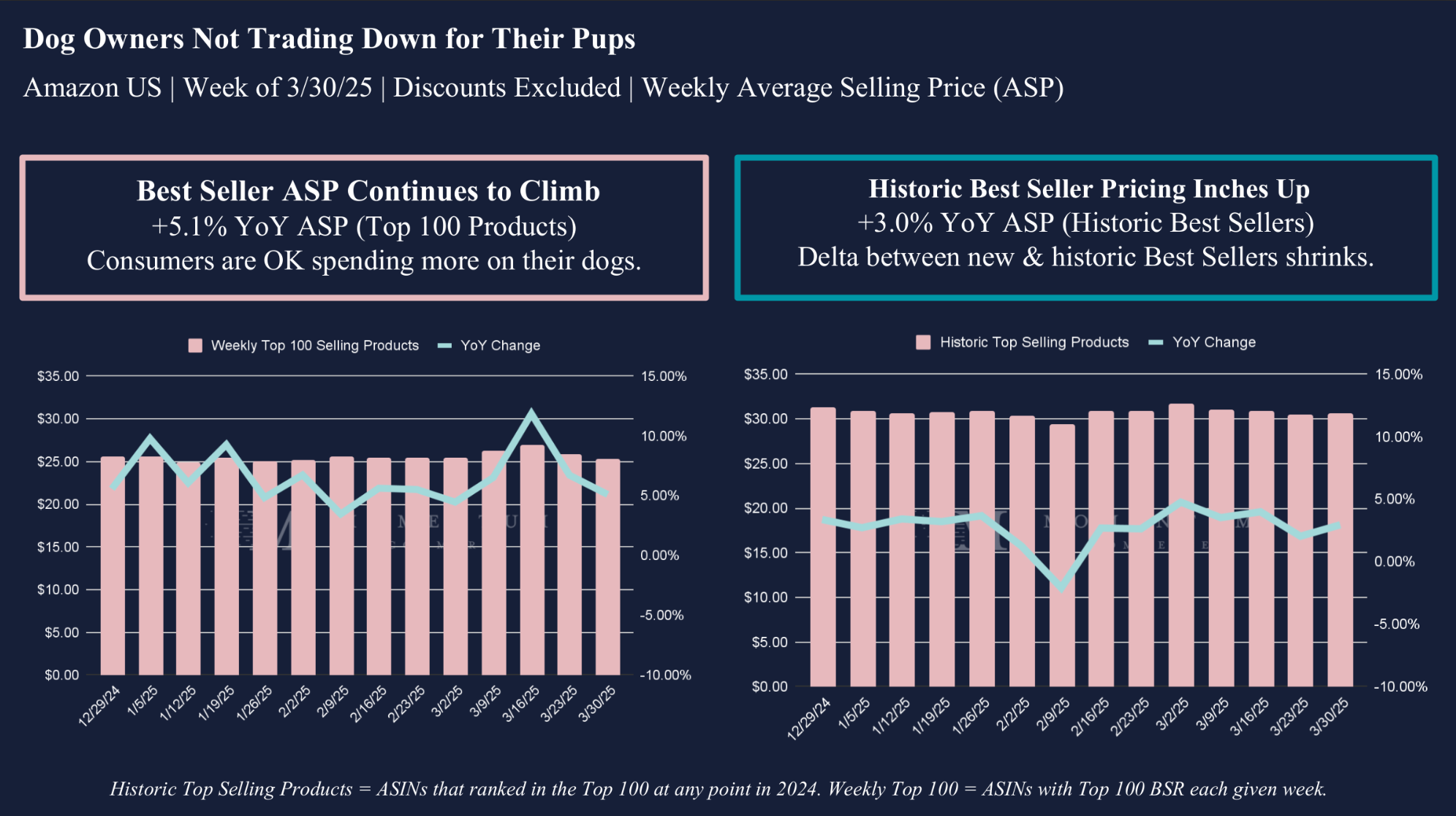

While the overall trend points toward frugality, some categories are bucking this pattern entirely. We're seeing fascinating resilience in what I call "emotional" purchase categories.

Dog care products have seen a 5.1% increase in average selling price among top 100 products.

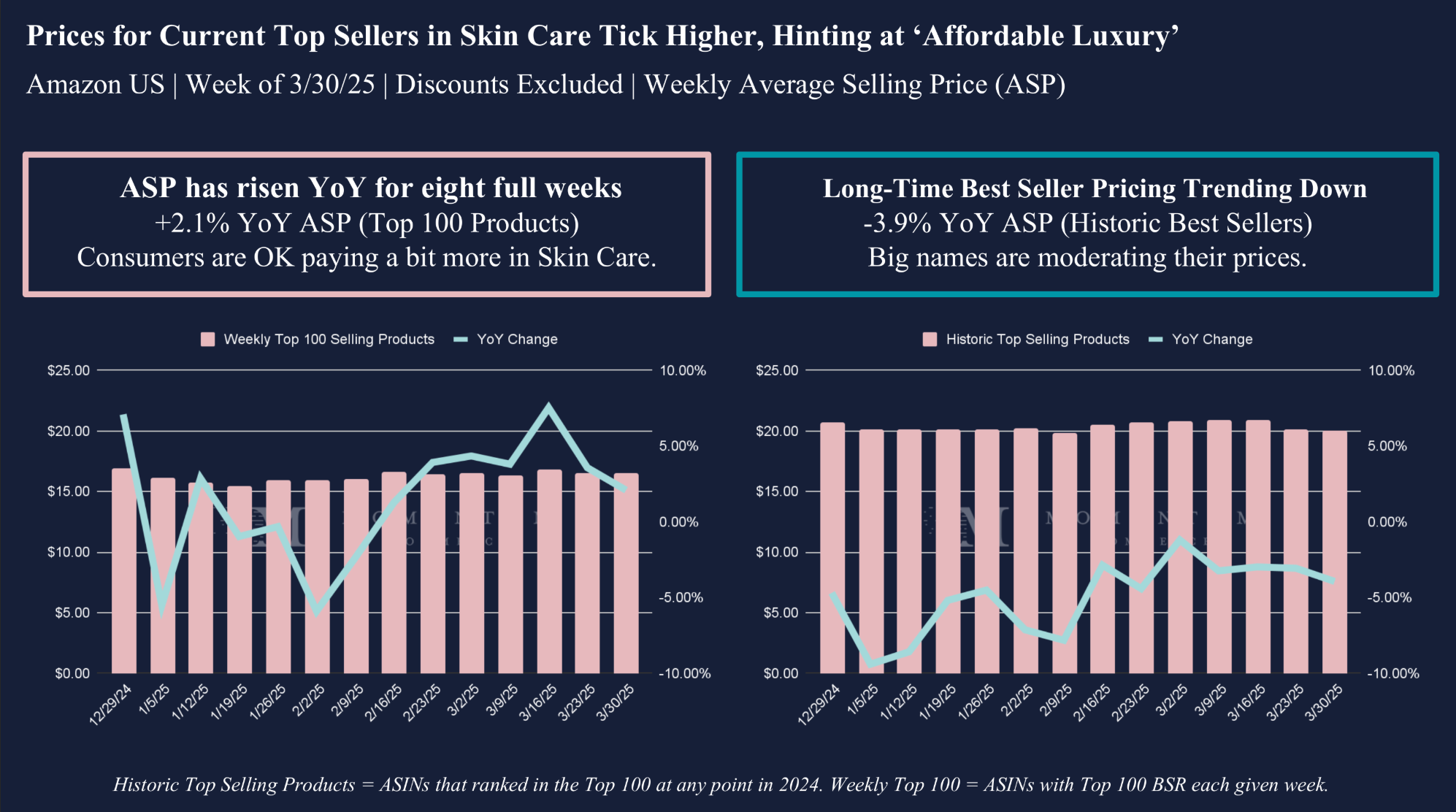

Makeup average prices are up a whopping 19% year-over-year. And skincare continues to maintain premium positioning.

What makes these categories different? Simple – they're emotionally driven purchases where quality trumps cost considerations. People might trade down on paper towels, but they're not skimping on their dog's food or their personal appearance.

What Smart Brands Should Do Now

For brands and retailers, the path forward requires nuance and category-specific approaches:

In value-driven categories:

- Highlight affordability in your messaging

- Consider introducing value-tier products if you don't already have them

- Create bundle deals that emphasize total value

- Leverage promotional offers strategically

In emotion-driven categories:

- Double down on quality messaging

- Maintain premium positioning without apology

- Focus on brand storytelling that reinforces emotional connection

- Resist the urge to discount unnecessarily

This is not an easy environment to navigate, but what's clear from Momentum's data is that it's not one-size-fits-all. A dog food brand can maintain premium pricing by leaning into the emotional connection people have with their pets. Meanwhile, a household cleaning products brand might need to emphasize value and efficiency to prevent customers from trading down.

The Bottom Line

Much like my son's rollercoaster experience on The Wipeout, we're witnessing consumers white-knuckling their way through, a shift in behavior that reflects broader economic anxiety. People are hedging their bets – stockpiling now to protect against future shortages or price increases, but doing so with an eye toward value.

For brands and retailers alike, this creates both challenges and opportunities. Understanding where each product category falls on the spectrum from "purely functional" to "deeply emotional" is critical for navigating these turbulent waters.

There's only one certainty: none of us have an emergency stop button for this ride.