Is retail media part of search, or is search part of retail media?

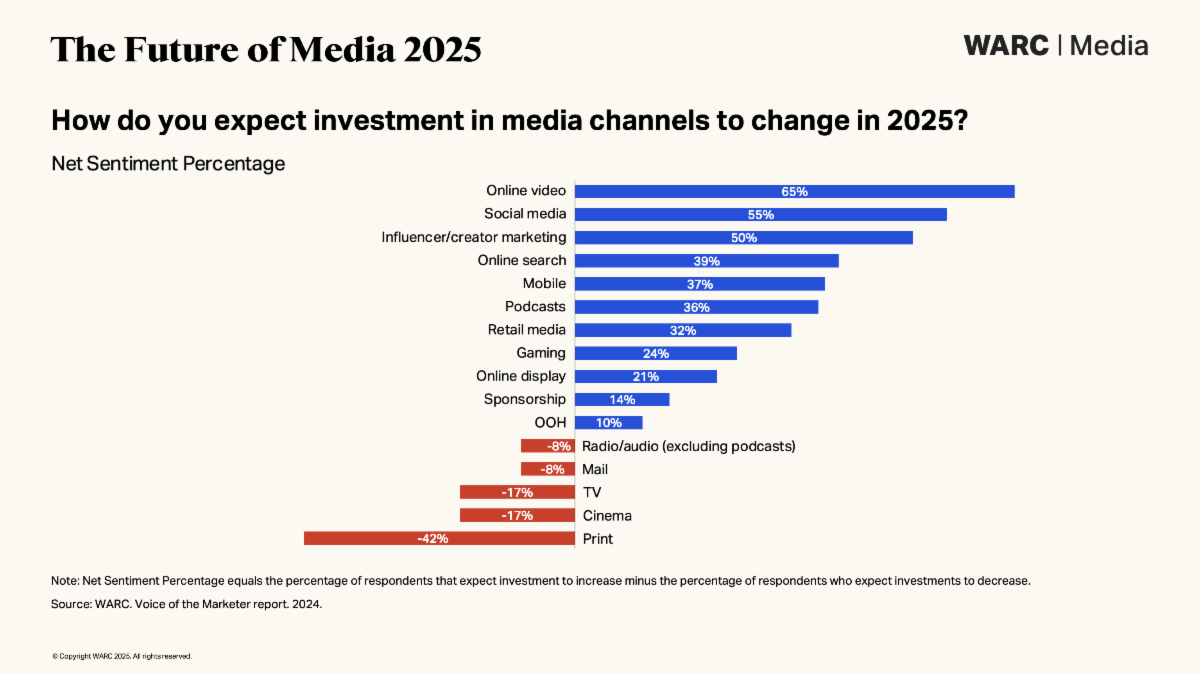

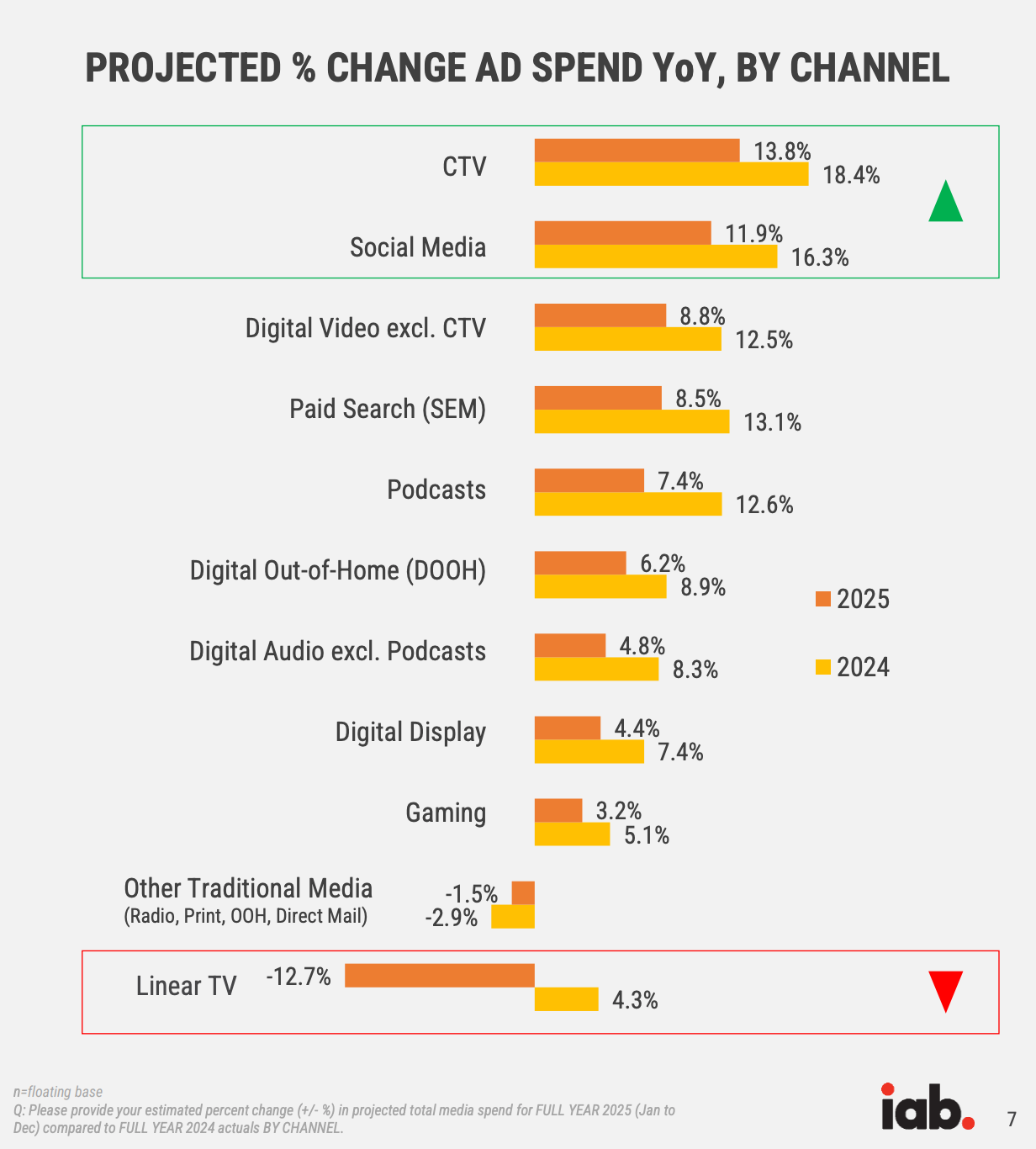

After reviewing the latest IAB and WARC projections for digital advertising dollars in 2025, something caught my eye. Both organizations are measuring retail media growth separately from CTV, digital video, and search.

IAB and WARC measure growth in core media channels, with retail media reported separately.

But Retail Media IS CTV, digital video, and search....

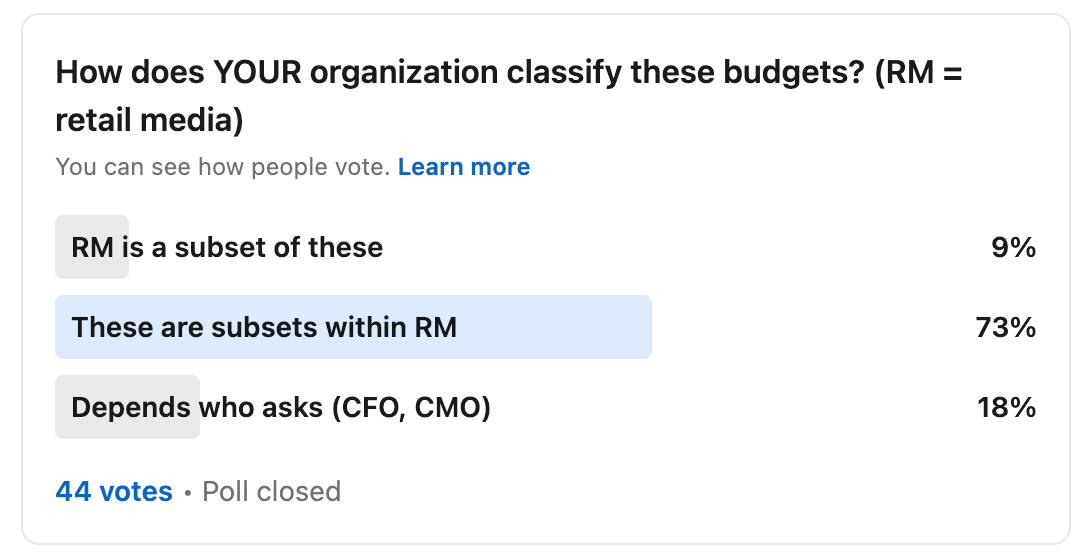

This got me thinking about how we classify these channels, so I ran a poll on LinkedIn to see how others approach this.

The results were fascinating: 73% of respondents view traditional digital channels as subsets within retail media. Another 18% said it depends on who's asking (CFO vs. CMO), while 9% see retail media as a subset of traditional channels.

The Historical Context

There's actually a logical reason why IAB and WARC measure retail media separately.

The IAB (Interactive Advertising Bureau) exists largely to set standards and best practices for digital advertising. As retailers joined IAB councils and recognized the need for consistent measurement, the IAB updated its guidelines and terminology.

Initially, “retail media” was folded under broader digital categories (e.g. search, display). Over time, the scale of retail media and the unique nature of first-party data usage have justified a separate line item.

I should also point out that Shopper marketing and trade marketing budgets have also historically been separate categories—quite distinct from brand-building or traditional media buys (TV, radio, print). But, for various reasons these are often not considered ‘marketing’ budgets, rather they are part of the cost to serve a retailer (more on that below)

But here's where we’re all still not agreeing on what retail media really IS, and where it should be funded and therefore measured .

In the comments on my LinkedIn poll, Wes Ryan, Connected Commerce Strategy Lead, at Mars United Commerce points out that even linear TV is now bookable through retail media networks, citing NBCU's Monday Night Football and Black Friday spots. His definition of retail media hinges on two factors: "if it 1) drives traffic to a retailer and 2) shows engagement data."

Allan Peretz, Founder of the agency Bold Retail, offers another perspective: "If you're using a retailer's first-party data, it's always retail media." While compelling, this definition also has its complexities as retail media networks expand their capabilities.

Kara Babb, a marketing consultant and ex-Amazon executive, raises a crucial point about how organizations actually handle these budgets:

“In my past orgs retail media was treated separately because the customer (Amazon etc) wasn’t split out from their media. For example, Amazon’s trade terms (AVN) were factored in to the total “cost to serve” which impacted Amazon ads budgets. In-store programs were pricey and spread over years that the remaining amount for retail media was depleted. RM is a challenge because it’s attributed to each retailer, vs spread as a total cost across the entire business— which IMO is how it should be accounted for.”

This gets to the heart of the matter for advertisers: the real question isn't about classification – it's about where the budget comes from and how to measure it effectively. When you're buying the same ad format (like video) from both retailers and traditional channels, how do you compare performance if they're sitting in different budget silos?

A Retailer's Perspective

For retailers building their own media networks, there's another crucial consideration: the more holistic and integrated your retail media offering, the better positioned you are to attract brand marketing budgets, not just shopper/trade dollars. This is particularly relevant as retail media networks expand into brand-building channels like CTV and streaming.

Internally, some retail media networks still operate as if “search” and “display” (and so on) are entirely separate products. Unifying these under a single RMN or offering integrated packages can encourage bigger deals from advertisers who see your network as a one-stop shop. Think Amazon DSP versus AMS. Amazon carefully rebranded to Amazon Ads, very astutely.

Looking Ahead

As retail media networks continue to evolve, offering everything from sponsored search to CTV, perhaps we need to rethink how we measure and benchmark these channels. The current approach of measuring retail media growth separately made sense when it was primarily about sponsored product listings. But as the lines between traditional and retail media blur, our measurement frameworks might need to evolve as well.

Look, its tough out there, and there’s not one single answer that will work for every brand.

What's clear is that both advertisers and retailers need more flexible approaches to budgeting and measurement – ones that focus on business outcomes rather than rigid channel definitions. The question isn't whether something is "retail media" or "traditional digital" – it's about understanding the total impact across all channels and optimizing accordingly.