Amazon has quietly launched one of the most significant developments in agentic AI shopping: a feature called "Buy For Me" that allows its AI to purchase products directly from brand websites when those items aren't available on Amazon's platform.

Though Amazon didn't name any brands in the announcement of this beta program, after many searches I finally found an instance of the program in the Amazon app.

In this post I'll share how the Buy For Me experience worked, why Amazon is doing this, and what the broader implications are for retail & retail media in the future.

If you want to dive deeper, I also posted an article on Forbes.com today: "Amazon ‘Buy For Me’ Is The Latest Entrant In The AI Shopping Agent Race"

My Experience Using "Buy For Me"

After trying to launch the feature by searching for all kinds of DTC brands that aren't sold on Amazon (Lululemon, Vuori etc) I finally hit the jackpot when I searched for Rothy's, a footwear brand. This DTC-native brand actually began selling on Amazon as a third-party seller just under a year ago. After searching for "Rothy's" in the Amazon app, I found the "Buy For Me" widget a couple of lines down on the search results page.

What immediately caught my attention was that the widget displayed styles not currently sold on Amazon's platform. While Rothy's offers a limited selection through its Amazon storefront, the "Buy For Me" feature presented additional variants like The Casual Clog, Rothy's Men's Clog, and The Loafer Mule—products that were previously only available on Rothy's own website.

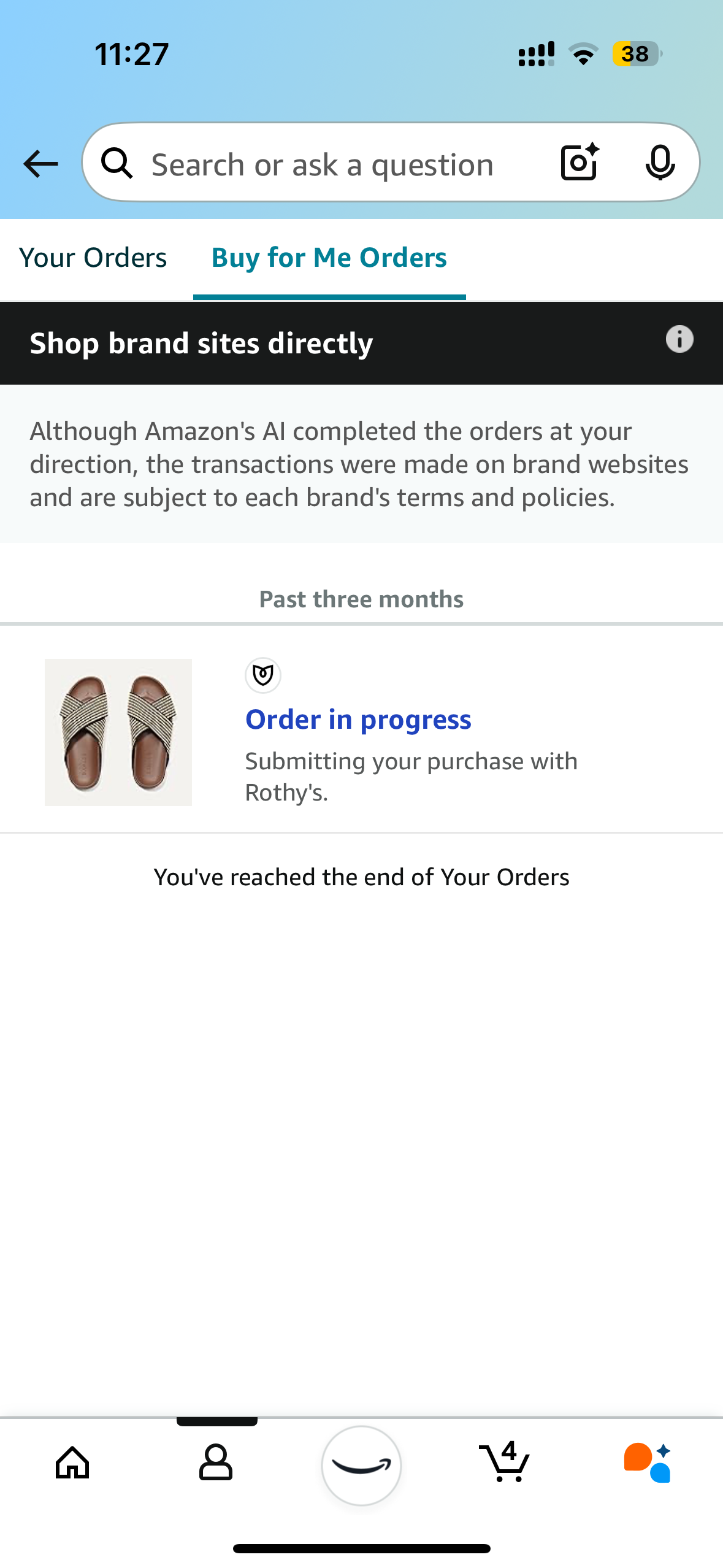

The purchase process was surprisingly seamless. After selecting my size and clicking the "Buy For Me" button, I received an order confirmation without ever leaving the Amazon app. The prices matched those on Rothy's website, and my order appeared in a separate "Buy For Me Orders" section, distinct from my regular Amazon orders.

What's perhaps most striking is how invisible the complexity is to the user. There's no sense that you're shopping anywhere but Amazon, yet behind the scenes, the company's AI is handling a complex transaction with an external retailer.

How "Buy For Me" Works Behind the Scenes

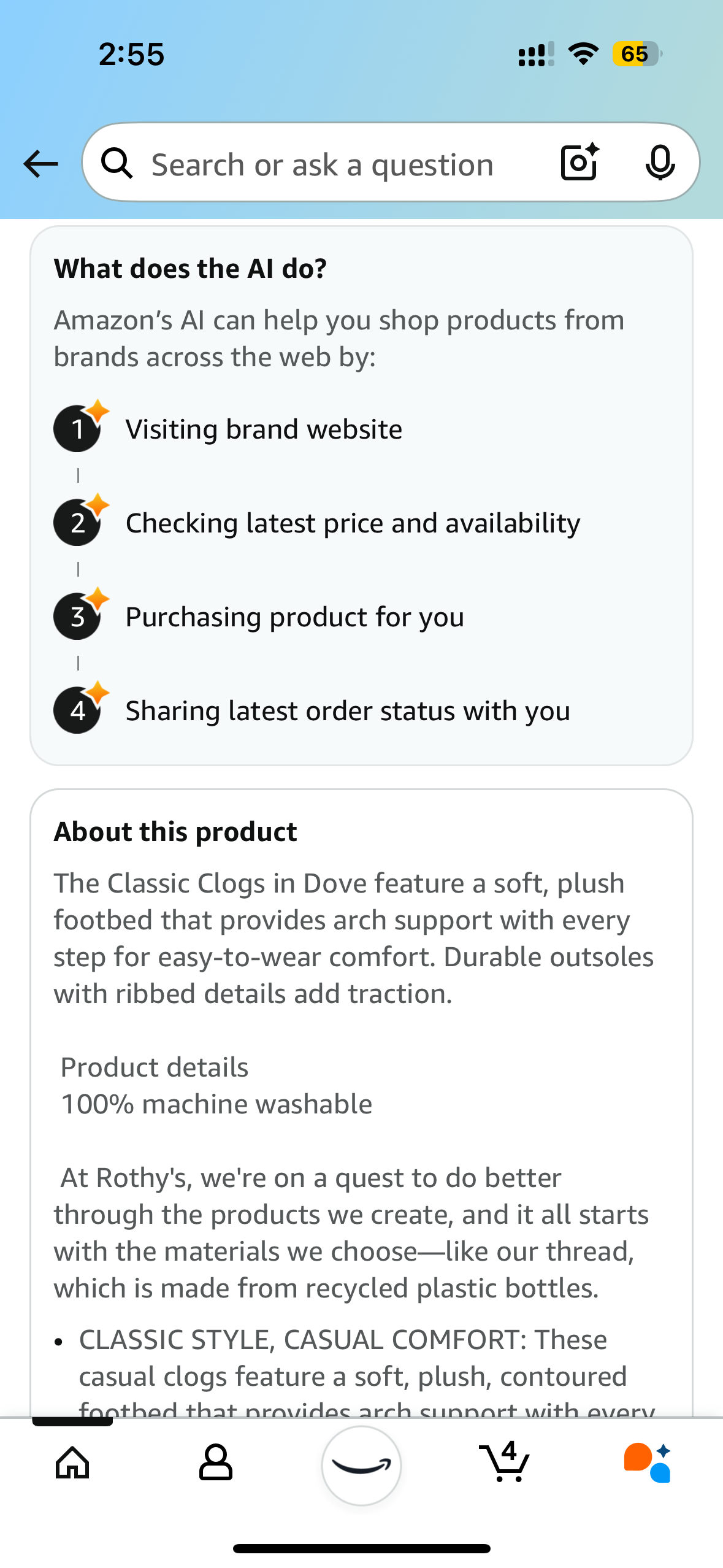

According to Amazon's announcement, "Buy For Me" uses agentic AI capabilities to make purchases on a customer's behalf. The system securely provides the customer's encrypted name, address, and payment details to complete the checkout process on the brand's website.

When a customer selects an item through the "Buy For Me" interface, they're taken to a product detail page within the Amazon app—similar to standard Amazon listings. If they decide to proceed, Amazon handles all transaction details without redirecting the customer to the brand's site.

After purchase, the customer receives order confirmation emails from the brand store and can track their order in the "Buy For Me Orders" tab in the Amazon Shopping app. Importantly, delivery, returns, exchanges, and customer service are managed by the brand store, not Amazon.

What This Means for Brands

For brands, the implications are mixed. According to Amazon's FAQs for the service, brands don't pay any commission or fees to be included in the beta program, and they maintain control over their pricing, product descriptions, and images.

The service creates a unique, secure email address for each order to facilitate communication between brands and customers. All communications from the brand are automatically forwarded to the customer, maintaining a direct connection while preserving Amazon's position as the intermediary.

Brands also retain control over their customer experience post-purchase, handling delivery, returns, and customer service independently. Amazon states:

When customers shop with the help of AI by tapping "Buy for me", Amazon prohibits the use of the transaction information, which we collect when customers purchase your products using our service, to make sourcing, inventory level, and pricing decisions for products in our store, including for offerings of Amazon’s store brand products.

The trade-off for brands is that they will not get the opportunity to cross-sell other items, enroll customers in loyalty programs, or capture email addresses for marketing purposes—all valuable touchpoints in a traditional direct-to-consumer transaction.

Why This Matters for the Future of Retail

Amazon's "Buy For Me" feature represents the most significant real-world implementation of agentic AI in retail to date. Unlike earlier shopping assistants that could only recommend products or add items to carts, "Buy For Me" can complete the entire purchase journey autonomously.

This development comes amid an increasingly competitive race to own the AI shopping experience. As I wrote recently in my analysis of Amazon's 'Nova Act', major tech companies are competing to control the future interface between consumers and products. Similarly, my Forbes article on Amazon's patent for Alexa+ highlighted the company's efforts to transform product discovery through conversational AI.

"Buy For Me" advances this strategy by positioning Amazon as the primary shopping interface, even for products it doesn't directly sell. By maintaining control of the customer relationship while expanding its product universe, Amazon strengthens its position as the starting point for all shopping journeys.

For consumers, the immediate benefit is convenience. A single, familiar interface to purchase virtually any product, regardless of where it's sold.

The Perfect Halfway Point?

What makes "Buy For Me" particularly interesting is how it balances competing interests. Amazon maintains its position as the customer-facing interface without forcing brands to sell directly on its platform. Brands gain exposure to Amazon's massive customer base while maintaining control of fulfillment, customer service, and pricing.

For Amazon, even without collecting merchant fees or capturing GMV (for now), the data insights are tremendously valuable. Understanding what products customers want that aren't currently available on Amazon could inform future inventory decisions and advertising opportunities.

This approach may represent a perfect halfway point in the current retail landscape. One that acknowledges both Amazon's desire to be the universal shopping destination and brands' need to maintain direct customer relationships.