Not so long ago, industry experts insisted people would never buy groceries online. "Consumers need to squeeze their own avocados," was the thinking said. Webvan tried, failed, but laid the groundwork. Instacart followed and transformed how we shop. Now, we're at another pivotal moment in retail history - one that could fundamentally change not just how we shop, but who controls the shopping experience itselfSince OpenAI's Operator launch last Friday, I've watched three distinct narratives emerge: "this will change everything," "why aren't they solving real problems," and "what happens to retail media if AI is shopping for us?"

While I'm typically skeptical of sweeping tech promises, this time feels vastly different. Here's why.

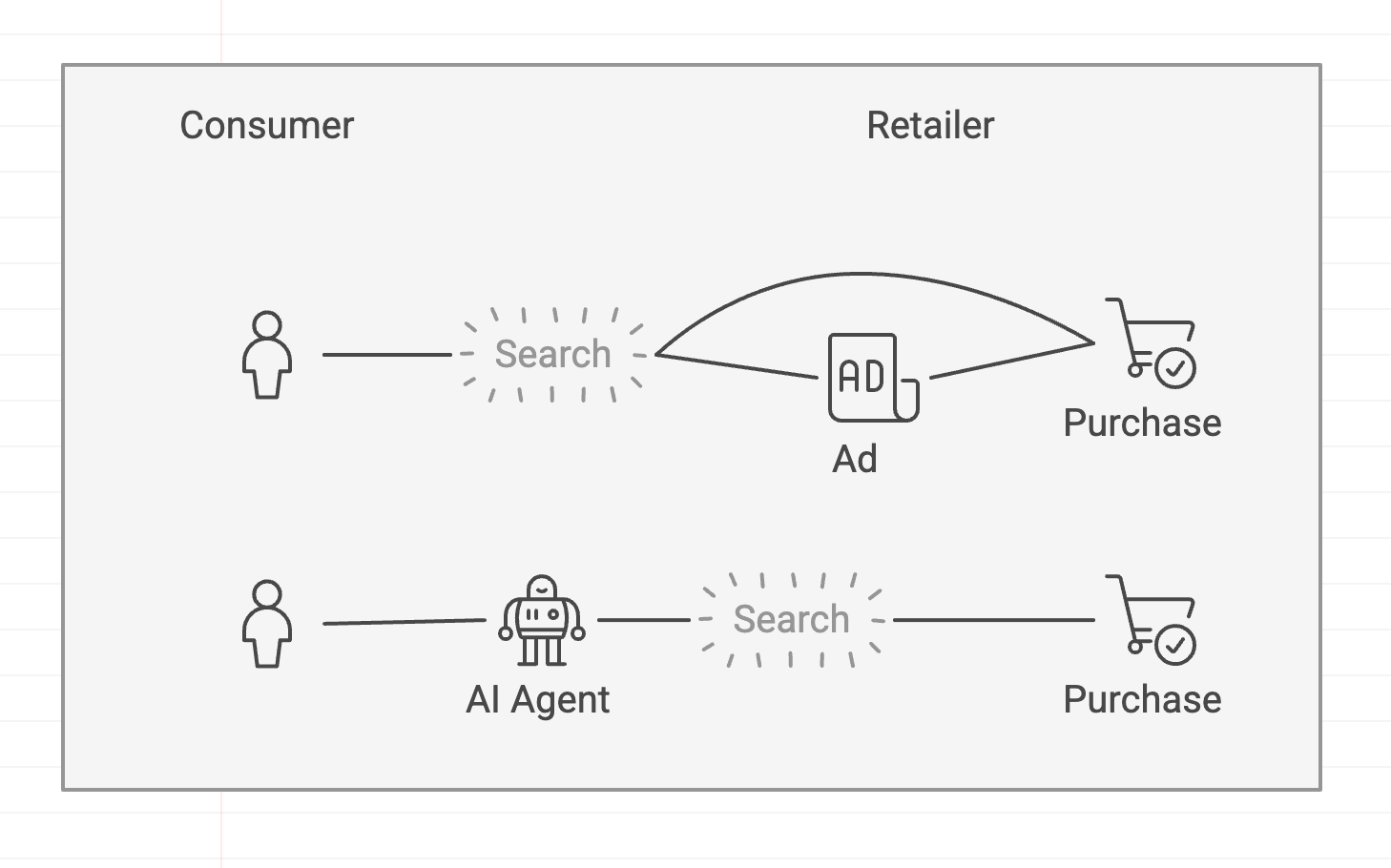

Today, when we shop online, we interact directly with retailers' websites and apps. We see their search results, their product recommendations, their sponsored listings. This direct interface is what makes retail media so valuable - retailers can monetize our attention through advertising because they control what we see when interacting with the assortment.

But let's imagine a new layer between us and retailers - an AI shopping agent that handles the tedious parts of shopping. Instead of manually comparing prices across multiple grocery stores, checking stock levels, and coordinating delivery times, we simply tell our AI agent: "Order my usual weekly groceries, but check if there are better prices at other stores. Use my preferred brands for coffee and cereal, but store brands are fine for everything else. Deliver to Home between 8 and 11AM Tuesday morning."

The AI agent becomes our primary shopping interface. It knows our preferences, our buying patterns, our brand loyalties. It can access multiple retailers simultaneously, compare prices, check availability, and execute purchases - all without us ever seeing a traditional shopping website or sponsored listing.

AI Shopping Agents Aren't Just Another Tech Gimmick - They're a New Layer Between Consumers and Retailers

This isn't just about convenience. It will fundamentally change who controls the consumer's attention. When AI agents become our primary shopping interface, they effectively unbundle the current retail media model. The sponsored listings and display ads that retailers now rely on for billions in revenue might never be seen by human eyes.

Now, not all shopping use cases are the same, and its worth considering the degree to which certain categories and scenarios are prone to AI disruption. My view is that low-consideration, routine purchases like grocery, household supplies and personal care will be the first to play out.

In this case, AI agents could handle everything from price comparison to reordering. They might even anticipate our needs based on past behavior: "I notice you're running low on dishwasher tablets based on your usual usage pattern. Would you like me to reorder?"

For discretionary purchases, like clothing, the role might be different but still significant. Just last week, my husband needed new t-shirts. He explained his specific criteria to ChatGPT, received targeted recommendations (which aligned with his Google searches), then visited a store to try them on. This hybrid approach - AI for discovery, human touch for final decision - shows how AI agents might complement rather than replace certain shopping experiences.

The implications are profound. When AI agents become the gateway to consumer purchases, the power dynamics of retail shift dramatically. Retailers and brands will need to optimize not just for human shoppers, but for AI agents. The future of retail media might not be about catching a consumer's eye with a compelling ad, but about ensuring your products are recommended by AI shopping assistants.

The Battle for the New "Digital Shelf" Will Make Selling on Amazon Look Like a Warm-Up Act

We've seen this pattern before.

In the mid-to-late 2000s, many brands and retailers wanted to keep customers on their own websites. Some believed Amazon was just an online bookstore or a threat they could contain. They feared losing control over pricing, brand presentation, and customer data if they sold products through a third-party marketplace.

As Amazon became a household name for “starting product searches,” traffic to brand.com sites plateaued or declined. Meanwhile, Amazon boasted huge customer volume, easy ordering, and Prime shipping.

Many retailers eventually returned or ramped up marketplace listings. By the mid-2010s, companies were spending significant fees on Amazon for better placement, sponsored product ads, and brand stores. What started as wariness ended in a recognition that ignoring Amazon means missing millions of potential customers.

Much like the shift to Amazon's marketplace, retailers in an AI-driven future might initially dismiss or block AI systems (e.g., refusing to share product feeds, data, or integrate with “agentic” platforms).

But once the consumer base relies on these agents for everyday shopping, any retailer or brand not playing ball could lose out on revenue. Ultimately, they’ll end up “paying the gatekeeper”—the AI platform—for visibility or premium listing.

The rise of AI shopping agents could trigger a similar transformation - only this time the stakes are even higher because these AI agents could hold much richer personal data about consumers—preferences, brand loyalties, even context like health or location—and could route purchases in ways that go well beyond standard search or marketplace listings.

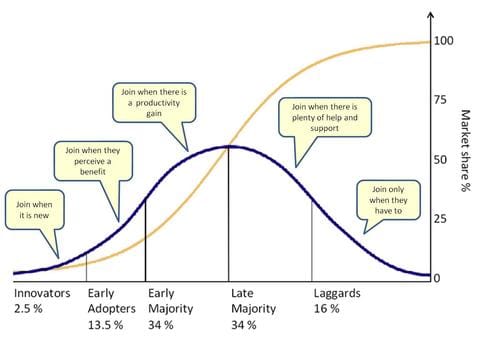

We're definitely in the "early adopter" phase of the maturity curve

Some of the pushback mentioned so far centers around the limited use cases for this technology so far. It's true that very few consumers are willing to pay $200/month to have an AI shop on Instacart for them.

And it may even get worse before it gets better. I think we'll see some swift reactions from retailers to block non-human traffic at first.

After all, this technology represents not only a short-term challenge around security and integration, but a handful of long-term existential threat to their business models -- revenues from retail media being just one of them.

But with time, some of these larger players will put the Innovator's Dilemma into practice and start to disrupt themselves. Yes, there are hurdles to overcome - security concerns, integration challenges, consumer trust. But if history teaches us anything, it's that convenience usually wins.

As AI adoption accelerates among consumers, who controls the consumer interface will control the new “retail media.” In some ways, it’s a re-run of the Google or Amazon era of search advertising—only now with hyper-personal data and no real “visual” interface.

This is just the beginning

In Part 2 of this topic I'll share what I think this all means for retailers and brands, and the future of retail media.