This post originally appeared in my column for Forbes.com, on Tuesday March 11, 2025.

When Best Buy launches its new U.S. marketplace this summer, it won't just be expanding its product assortment—it'll be laying the foundation for a more robust advertising business. While retail media leaders Amazon and Walmart have built diversified advertising revenue streams through thousands of marketplace sellers, Best Buy's opportunity lies ahead. By creating a vibrant third-party marketplace, Best Buy can potentially monetize more searches, tap into a new base of advertisers beyond its current stable of major brands, and introduce new ad formats tailored to an expanded product selection.

As CEO Corie Barry noted in the company’s earnings call last week, these two priorities are "intertwined," with the marketplace expected to "provide opportunities for Best Buy Ads through new advertisers and increased traffic."

When Best Buy abandoned its first marketplace attempt in 2016, retail media networks barely existed in their current form. Today, the landscape has transformed dramatically—with marketplace-based retailers consistently outperforming their non-marketplace counterparts in advertising revenue potential.

Second Time's The Charm?

This isn’t Best Buy’s first attempt at a marketplace. The electronics retailer launched an online marketplace in 2011 and operated it for five years before shuttering the business around 2016.

But the retail environment has evolved significantly since then. Best Buy's timing for this second marketplace attempt aligns with two significant trends: the maturation of retail media networks and increased sophistication around marketplace operations.

Best Buy is partnering with Mirakl, an enterprise marketplace technology company that works with major retailers including Macy’s and Kroger, to build its new platform. The retailer also has the advantage of learning from its Canadian marketplace operation, which has been running successfully for several years.

"This is one of those places where we have a distinct advantage in that at least some portion of the company has been dealing with Marketplace," Barry told analysts during the company’s Q4 2025 earnings call. An analyst on the earnings call cited a statistic that in Best Buy’s Canada marketplace, one in every four items shipped is from a 3P seller, which could provide a potential roadmap for U.S. growth.

The Marketplace-Advertising Connection

While expanding product selection is certainly one motivation for launching a marketplace, the advertising potential may be even more compelling. Best Buy's leadership made this connection explicit in their recent communications with investors, positioning Best Buy Marketplace and Best Buy Ads together as key components of their fiscal 2026 strategy to "launch and scale incremental profit streams."

This approach follows a pattern established by the most successful retail media networks. Doug McMillon, Walmart's CEO, articulated this strategy clearly in 2022: “Growing our marketplace expands choice for our customers, helps our sellers grow, and enhances our profit margins. As we bring more customers, sellers, and suppliers into our ecosystem, it expands our ability to monetize those relationships... And as our e-commerce business, including marketplace, continues to grow, so will our advertising business.”

In its Q4 FY25 earnings, Walmart said its Marketplace grew 34% in the U.S., and Walmart Connect revenue grew 24% year over year – incredible growth within a company that grew 4.1% overall. And Walmart calls out advertising specifically as a high margin business, driving increased operating income.

The Long Tail Advantage

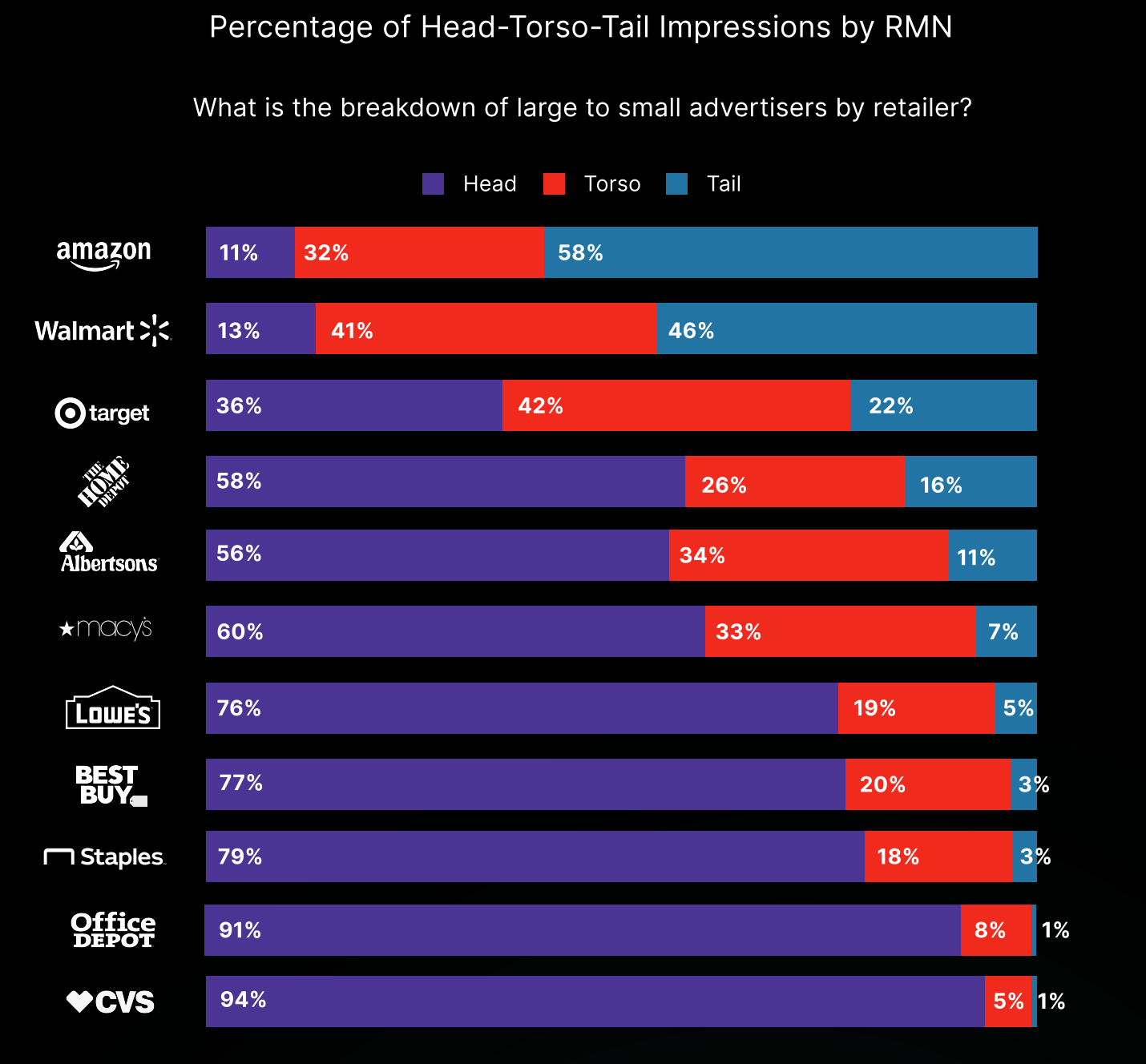

One of the most compelling reasons for Best Buy to build a marketplace is to create a more diversified advertiser base. According to research from Pentaleap and Colosseum Strategy, Best Buy currently has a highly concentrated advertiser base compared to marketplace-based competitors. (Disclaimer, Pentaleap is a client of mine)

While Amazon derives 58% of its ad impressions from "long-tail" advertisers (those representing less than 0.2% of overall impressions) and Walmart achieves 46%, Best Buy gets just 3% from this diversified base. Instead, 77% of Best Buy’s ad impressions come from a handful of major brands—creating vulnerability if any of these advertisers reduce spending.

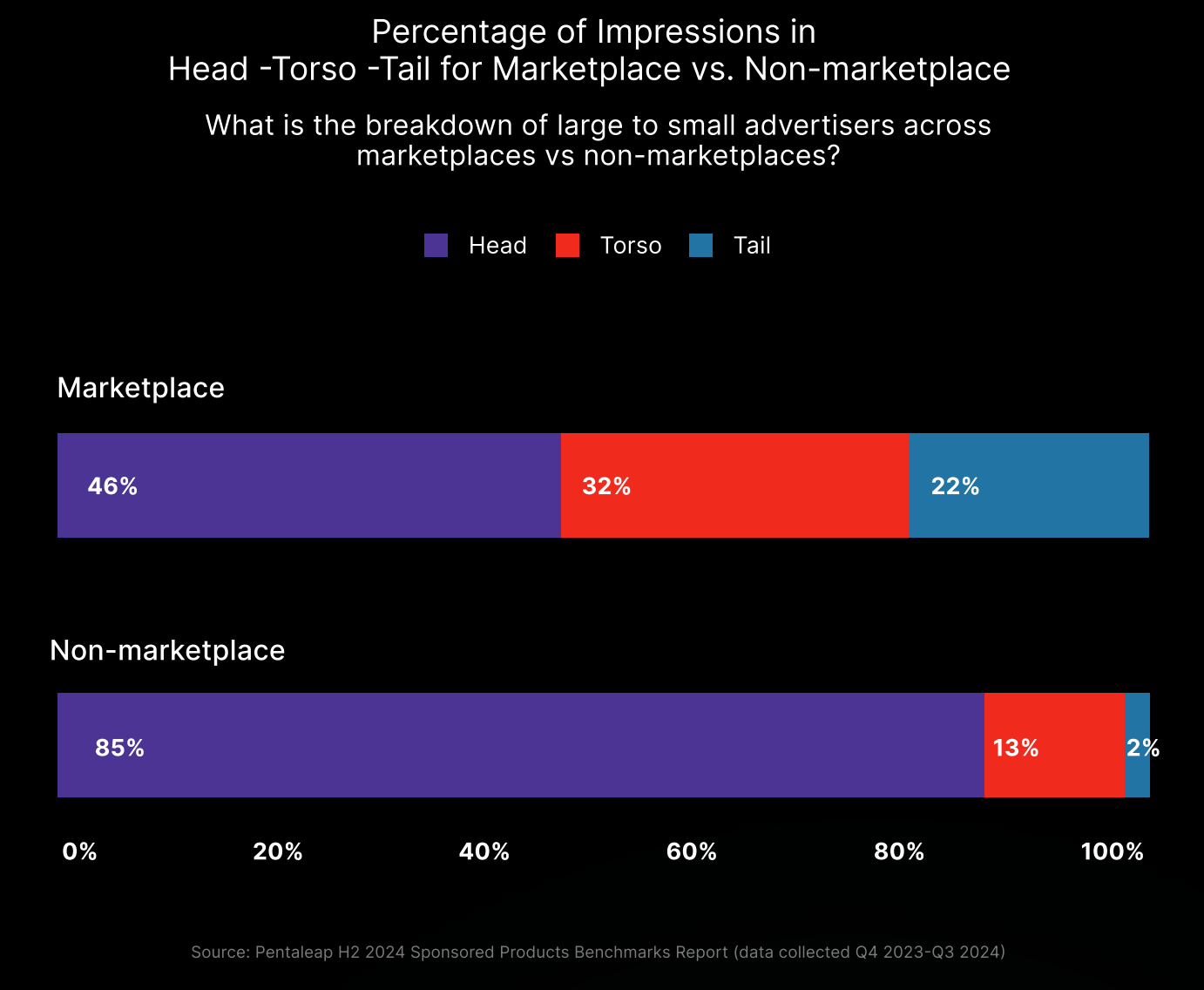

This concentration challenge isn’t unique to Best Buy. The research notes that non-marketplace retail media networks typically see only 15% of ad impressions come from mid- and long-tail advertisers, compared to 54% for marketplace-based networks.

A robust marketplace helps solve this problem by bringing in hundreds or thousands of smaller sellers who then become potential advertisers. These sellers often have stronger incentives to advertise, as they need visibility to compete with established brands and first-party products.

“The biggest digital ad businesses in existence today—including Google and Meta—also thrive on their long tail of advertisers,” says retail industry analyst, Andrew Lipsman. "This wide base not only provides a sturdy foundation on which to grow, it also inoculates the platform against spending cuts from any single advertiser."

Seller Perspective: Mixed Response

Early reaction from potential marketplace sellers has been mixed, according to interviews with several brands in the consumer electronics space.

Bernie Thompson, founder of Plugable Technologies (which makes laptop docking stations and USB products), expressed enthusiasm about being among the early brands accepted into the marketplace. "We’re excited to be among the early brands accepted into Best Buy’s new Marketplace," Thompson told me. "Best Buy is synonymous with electronics. We think it's a great fit and hope we can make a positive impact for Best Buy and their customers."

Thompson sees an opportunity for Best Buy to differentiate itself through better curation. "Amazon has a sophisticated but chaotic curation system... that also has long-standing flaws that lead to an increasing number of fly-by-night Chinese brands on the platform. Best Buy has an opportunity to stand out if it can establish and maintain the big 5: selection, pricing, speed of delivery, customer trust, and brand trust."

However, others express concerns about potential channel conflict. One consumer electronics brand executive, speaking on background, noted that "we have authorized 3P sellers that are eager to sell on the Best Buy marketplace which creates channel conflict and ultimately creates a situation where we compete against ourselves."

Rahul Saraswat, SVP of Ecommerce at Aventis Systems, a company that sells consumer electronics and IT hardware across multiple marketplaces, said his company would "try out this marketplace for sure" given the natural fit with Best Buy's customer base. However, he added that "a lot will depend on how well the marketplace does and how favorable or unfavorable the costs and terms are."

On the advertising connection, Saraswat was more skeptical about whether retail media spend follows marketplace presence proportionally. "For us, they do not because Amazon is the 10 thousand-pound gorilla in the room. We are an Amazon-first business, and most of our Ad spend dollars support that channel."

Building a Differentiated Marketplace

Best Buy’s US marketplace appears to be taking a somewhat different approach than its Canadian counterpart. While the Canadian marketplace has historically focused more on refurbished and rebuilt products, CEO Corie Barry indicated the U.S. version will offer "even more new products" and "multiple versions of the same SKUs."

The company is also planning phased implementation of seller-friendly features. At launch, Best Buy will facilitate product returns at physical stores, with "capabilities such as fulfillment as a service for sellers" coming later. This fulfilment capability is a significant enabler for third party resellers. A strong draw for both Amazon and Walmart’s marketplaces is the ability for sellers to tap into the logistics capabilities of those retailers. Not having to store inventory or fulfill orders makes the platform accessible to more sellers. Having orders fulfilled by Best Buy also engenders more trust among consumers.

To protect its brand reputation, Best Buy emphasizes that "all potential sellers will go through a vetting process, so we can ensure our customers receive the positive experience that they would expect at Best Buy."

Financial Expectations

Despite start-up costs and potential cannibalization of first-party sales, Best Buy's leadership expects the marketplace to have "a positive impact on our operating income rate" in fiscal year 2026, though they declined to provide specific revenue projections.

CFO Matthew Bilunas told analysts in the earnings call, "We would see both [Marketplace and Ads] to continue to present, I would say, some revenue and profit opportunities as we move forward... those would both be contributors to helping us expand an operating income rate as we get into the next couple of years."

The marketplace launch is targeted for mid-2025, meaning its full financial impact won't be felt until the following fiscal year. However, the company's leadership clearly views it as a long-term strategic investment rather than a short-term revenue boost.

As retail continues to evolve, Best Buy's marketplace relaunch demonstrates how thoroughly the playbook has changed since 2016. For today's retailers, a marketplace isn't just about expanded selection—it's about building the foundation for a more sustainable advertising business with a diverse base of smaller advertisers complementing established brand relationships. The success of Amazon and Walmart suggests this strategy works. The question now is whether Best Buy can execute it effectively the second time around.