Why Is Amazon Suddenly Linking to Other Retailers? It's About the Ads

Amazon's ad engine is getting hungry.

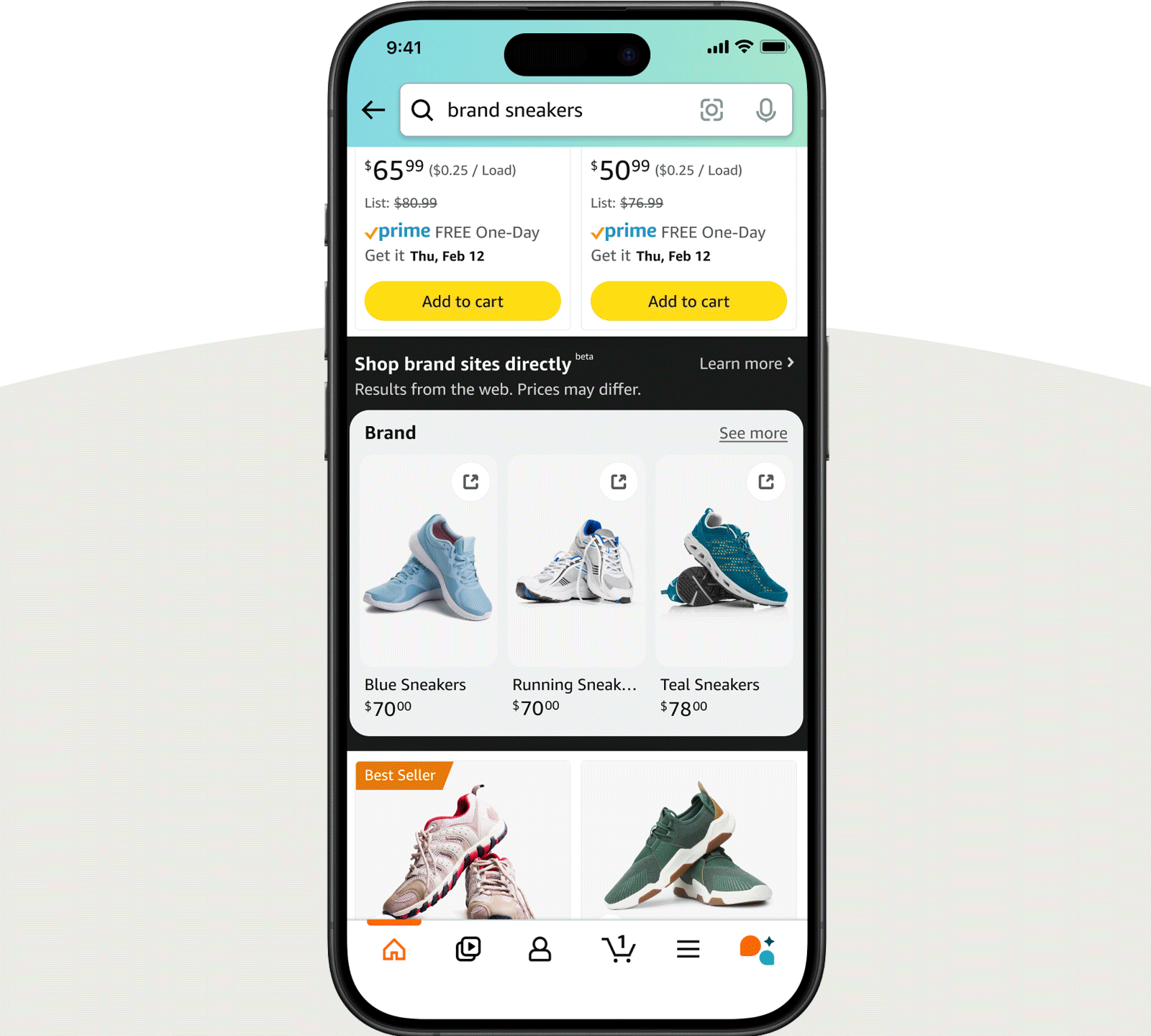

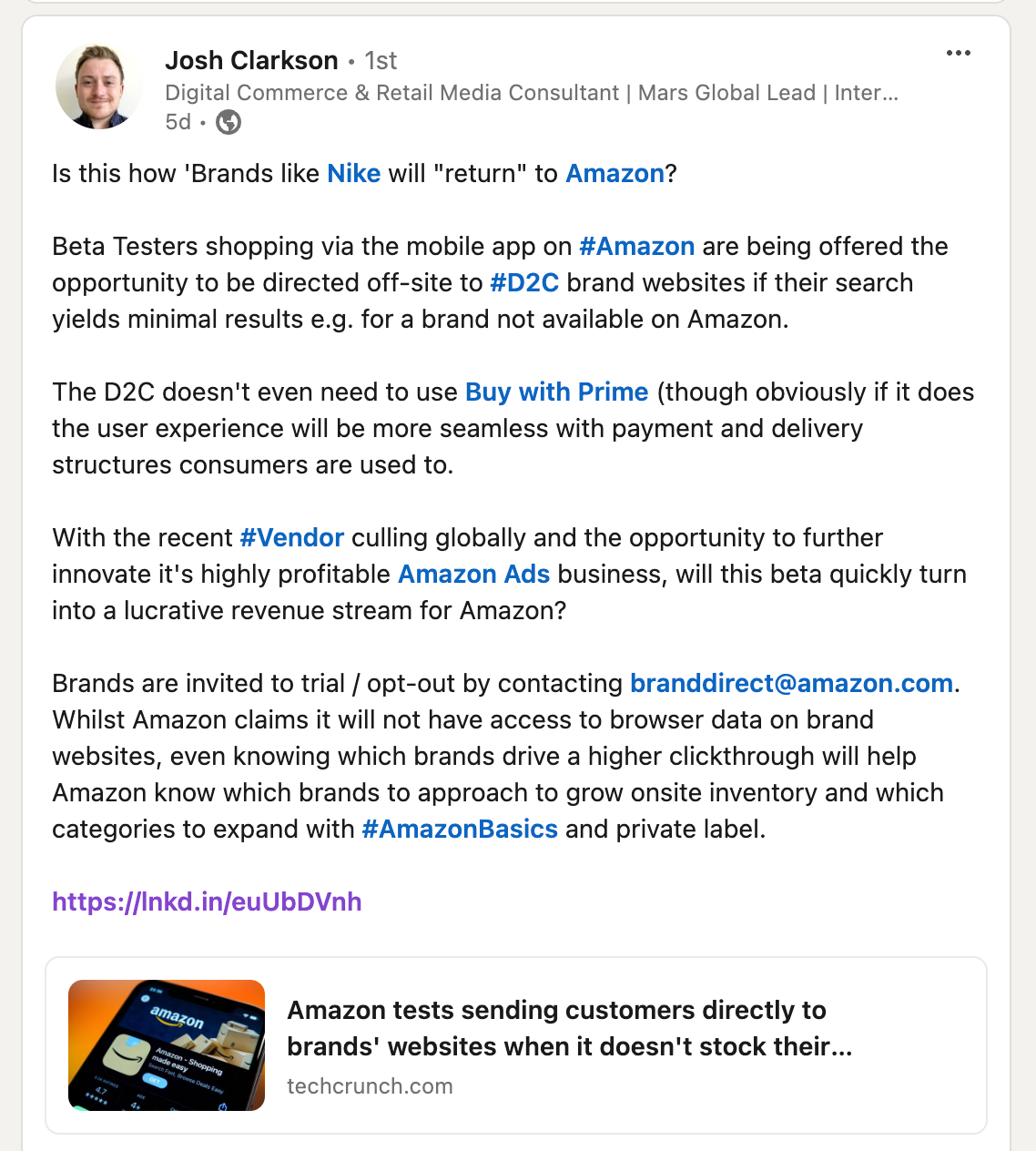

The e-commerce world has been buzzing since Amazon's February 11th announcement that they're testing off-site product links in their mobile search results. My LinkedIn feed has been filled with speculation about Amazon's motivations for this unexpected move – after all, Amazon has spent decades perfecting the art of keeping shoppers within their ecosystem.

But to me, the reason is clear: This is fundamentally about expanding Amazon's advertising inventory.

Rick Watson, host of The Watson Weekly and veteran e-commerce analyst, captures this perfectly. "Amazon's ad engine is getting hungry," he notes in his podcast that dropped yesterday. Rick points out that this move comes amid significant disruption in the search and AI landscape, with Amazon needing more user intent data at a time when much of that valuable information is flowing to Google and ChatGPT.

Of course, there's no shortage of alternative theories floating around. Some suggest this is about improving customer experience by expanding product selection. And that's certainly what Amazon's press release plays, up, for whatever that's worth.

Others see it as a data collection play to identify assortment gaps or inform private label development. There's even speculation that this could be Amazon's first step toward building a full-fledged comparison shopping engine to compete with Google Shopping.

While these factors likely play a role, I think they miss the bigger picture. Bigger, as in $50BN of revenue at a 70-80% profit margin.

I'm talking about Amazon's advertising business, of course, which faces a fundamental constraint: limited on-site real estate for ads. Yes, they've made impressive strides with CTV advertising through Prime Video and live sports, but these channels primarily serve large brands with sophisticated programmatic buying capabilities.

The challenge lies in the middle. Amazon needs to find new ways to monetize their massive user base and shopping intent data. Off-site product links could be the perfect solution, offering a new advertising format that bridges the gap between traditional on-site sponsored listings and broader brand awareness campaigns.

Think about it: By including external product listings in search results, Amazon creates an entirely new advertising surface that doesn't compete with existing inventory. Brands get access to Amazon's high-intent traffic while maintaining their direct relationship with customers. Amazon gets to monetize searches even when they don't have the product in their catalog.

The timing is particularly interesting given recent shifts in the digital advertising landscape. With Google facing AI disruption and ongoing privacy changes affecting traditional targeting methods, Amazon is well-positioned to expand its advertising footprint beyond its own walls.

For now, this remains a limited test in the U.S. mobile app. But if successful, it could represent a significant expansion of Amazon's advertising capabilities. As Rick Watson suggests, we might be seeing the early stages of Amazon's push to challenge Google's dominance in product discovery and comparison shopping.

My prediction? If the beta test shows promising engagement rates, we'll see this feature rapidly expand – likely with a "Sponsored" version rolling out alongside the organic listings. For brands and advertisers, this could open up exciting new opportunities to tap into Amazon's valuable consumer intent data while maintaining direct customer relationships.